The cabinet in Lebanon has approved a draft law that could reimburse depositors after six years of one of the worst financial crises in history.

The Lebanese currency started to devalue in droves in 2019. Depositors were prevented from accessing their money by banks who locked their doors.

Recommended Stories

list of 3 itemsend of list

Some depositors were forced to hold up bank branches to receive their own funds.

The Lebanese Lira had lost 98 percent of its value by the time the currency was being regulated.

A so-called “gap law” is expected to be signed by the president and the prime minister before being presented to parliament for discussion in order to resolve the situation.

Everything you need to know about the so-called “gap law” is provided here.

What benefits does the law offer?

Depositors will receive a portion of their deposit back.

Anyone who deposits up to $100, 000 will be reimbursed within four years, as per the law. This proposal makes more sense than previous ones, which required the same sum to be paid for over a decade.

However, observers noted that depositors could receive up to $500 000 back under the plans proposed in 2020, which were put to the test by former prime minister Hassan Diab.

According to Fouad Debs, a member of the Depositors Union and a lawyer, “This was probably the biggest lost opportunity,” the bank was protected.

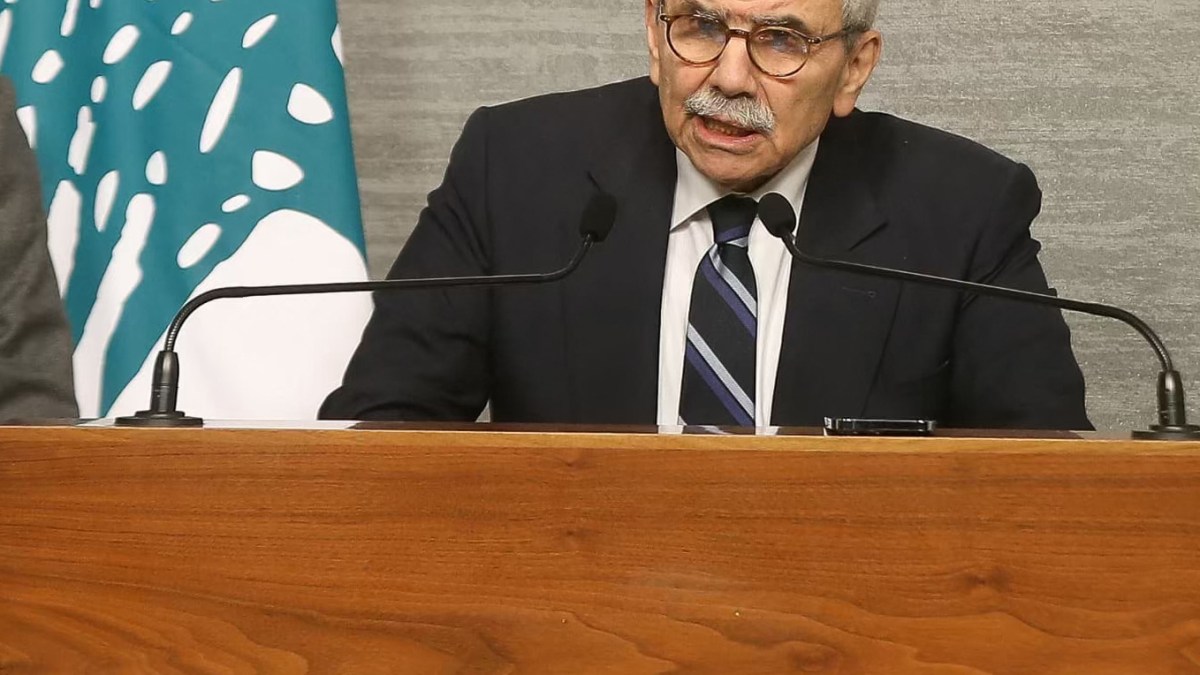

According to Prime Minister Nawaf Salam, there is also a rumored full financial audit.

According to Debs, “a forensic audit” means that the banks will begin all of their operations, including their dividends and bonuses, as well as the financial engineering they have done, “practically.”

Because “there are a lot of discrepancies between what they say and what the state is saying,” he added, an audit is crucial.

What’s wrong with it, exactly?

Plenty.

First of all, each depositor is entitled to a $100, 000 check, not each account. So, for example, if someone had two accounts for more than $100 000 and received more than $100,000.

According to PM Salam, depositors who have more than $100 000 in their account or accounts will receive $100 000 in cash, while the rest will be paid in bonds backed by the Central Bank.

What is the purpose of the draft law? Who is it appointing?

Under the current draft law, the bankers, the banks, and politicians who align with them can get away with it, but the state will bear the majority of the cost of the financial collapse.

Despite playing a significant role in creating the financial crisis, banks are only accountable for paying 40% of withdrawals under the draft law’s current version.

Banks, bankers, and affiliated politicians are still using media outlets and lobbying parliament to criticize the law and make it even more favorable for them.

Banks are now required to pay significantly more than they currently do, but still significantly less than critics claim they should.

The claims lack clarity.

Banks were still able to give shareholders dividends and receive executive bonuses during the crisis, but regular depositors were prevented from using their money for everyday needs like food and paying bills.

Debs argued that “depositors should be the last ones on the list to pay.”

What would the state be required to pay?

The Lebanese financial system can’t pay out the “gap” between what depositors owe to Lebanese banks and what the state can recoup.

According to estimates, the current gap is $70 billion.

Who is supposed to be responsible for this, according to the bankers?

They assert that the government should be reimbursed. Many banks and banks claim to have given their money to the Central Bank of Lebanon (BDL), which received it from the state, which ultimately lost it. The state should therefore be responsible for paying.

However, critics claim that many banks did not ask depositors for their deposits and instead gave them to BDL.

Because banks made a lot of money and gained a lot from it, Debs claimed. The banks were well aware that they put all of their eggs in the same basket.

What would the state be able to pay?

Essentially, using public funds. Everything else will be refunded once the depositors receive the funds, including Lebanon’s gold reserves, in bonds that are backed by the state and its assets.

Because many of Lebanon’s current bonds were sold to vulture funds abroad, critics claim this is problematic. So, essentially, state assets could be used to repay vulture funds or repay large depositors at the expense of the entire Lebanese population.

What is the IMF’s position?

Although the International Monetary Fund (IMF) frequently calls for austerity, civil society and the IMF are once again on the same page.

Source: Aljazeera

Leave a Reply