The tariffs are scheduled to go into effect on August 1 for US President Donald Trump. They represent a significant increase in US trade policy, which causes higher prices for consumers and greater financial losses for businesses.

Trump initially delayed “reciprocal tariffs,” which he had announced on April 2, allowing nations to reach trade agreements with the US.

US Commerce Secretary Howard Lutnick described the August 1 tariffs as a “hard deadline” on Sunday.

What tariffs apply on August 1?

On August 1, several nations will be subject to a string of tariffs. Countries will be subject to various levies, ranging from 15% on Japan and the UE to 50% on Brazil, despite the situation’s continuing dynamic.

Who has made last-minute agreements?

In the last few days, Trump has entered into a number of bilateral trade agreements.

Through a quota system, the US secured $750 billion in energy purchases and lower steel tariffs. In exchange, it reduced auto tariffs by 30% to 15%, keeping them the same for semiconductors and pharmaceuticals.

While boosting rice imports in the name of the 100, 000-tonne duty-free quota, Japan committed $550 billion in investments aimed at US industries like semiconductors, AI, and energy. Additionally, it will purchase US-based defense goods, aircraft, and ethanol.

Although Jakarta has only confirmed tariff cuts and significant commodity purchases so far, it is reported that Indonesia has agreed to pay no tax on many US products and increased imports of energy and agricultural products.

The UK also received 1.4 billion litres of ethanol and aerospace export benefits as well as the US duty-free beef quotas and the benefits of the UK’s trade policy.

China’s reciprocal tariffs were reduced from 145 percent to the pre-all-time low of 10 percent. Additionally, fentanyl trafficking is subject to a 20% punitive tariff. As the two negotiate a deal, there will now be a temporary pause for the final tariff rate until August 12. China resumed rare earth exports and accepted Boeing deliveries in line with the cut and eased non-tariff restrictions.

Although not all of the terms in the agreements with the Philippines, Cambodia, and Vietnam have been confirmed by those governments, they also include tariff adjustments and market access.

Which industries are likely to suffer the most?

The worst hit from tariff threats was experienced by automakers, airlines, and consumer goods importers during the first-quarter earnings season, according to a Reuters news agency tracker that examines how businesses are reacting to Trump’s tariff threats.

Costs increased as a result of taxes being levied on electronics like semiconductors.

According to Joseph Foudy, an economics professor at the New York University Stern School of Business, “when you start seeing tariffs at 20 or more, you reach a point where businesses may stop importing altogether.”

According to Foudy, “Firms simply delay major decisions, delay hiring, and economic activity declines.”

Many businesses built up their stockpiles of inventories in advance of rising costs, but economists are all in agreement that the effects of the tariffs in place so far have not been fully felt.

Even the current level of US tariffs, including a baseline 10 percent duty on almost all nations and higher levies on cars and steel, could stymie economic growth, according to a study released last month, and still contribute more than 2 percentage points to the global gross domestic product (GDP) in the medium term.

Prices have gone up, or not?

Until early March, prices of US-made and imported goods saw modest seasonal declines, with imports experiencing even greater declines. Prices rose after broader tariffs were imposed on March 4, including a 25% tariff on imports from Canada and Mexico and an additional 10% tariff on China, despite the first 10% US tariff on Chinese goods (February 4). Domestic goods’ prices increased by half as much as domestic goods’ prices, while prices for imported goods increased by 1.2 points.

Import prices increased sharply after a 10% global tariff was announced on “Liberation Day” on April 2 and a 145 percent increase on China on April 10. Following the May 12 tariff rollback on Chinese goods, prices briefly decreased, but things started to change again in June. Import prices have increased only marginally since March compared to headline tariff rates, increasing by about 3 percent.

Have tariffs sparked financial growth?

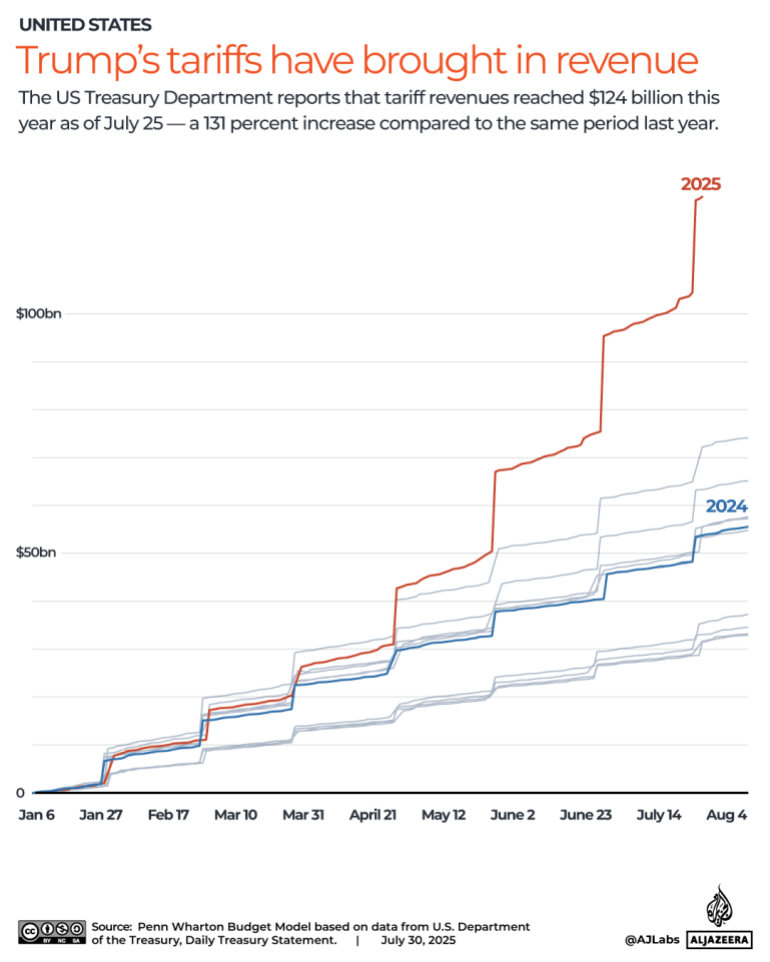

Importers have benefited from Trump’s tariffs’ higher taxes. According to US Treasury Department data, the US generated $ 124 billion in tariffs this year between January 2 and July 25. This is a 131 percent increase over the same period last year.

As collections from Trump’s trade campaign increase, Treasury Secretary Scott Bessent predicted that this could reach $300 billion by the year 2025.

Source: Aljazeera

Leave a Reply