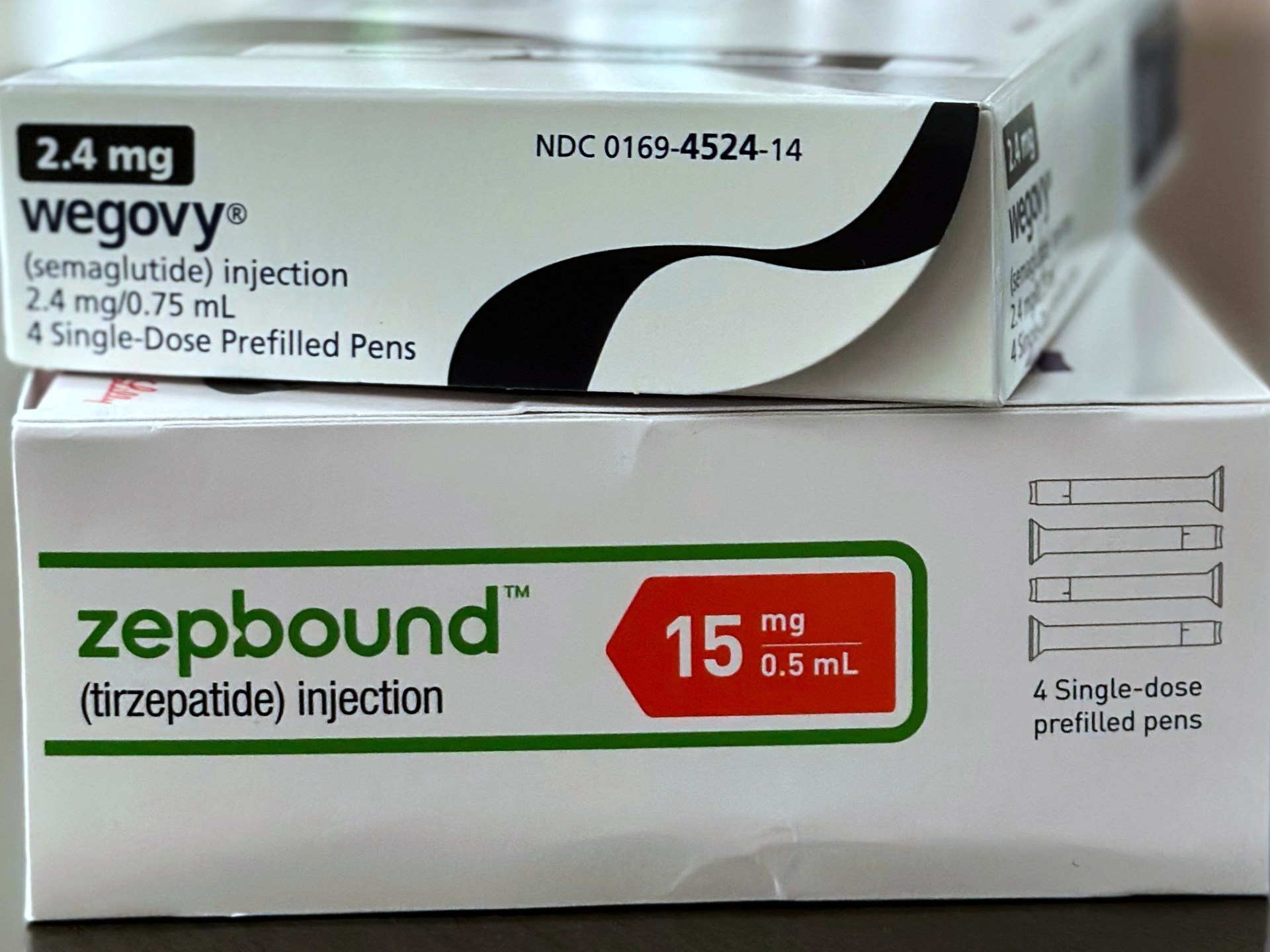

Lars Fruergaard Jorgensen, the company’s CEO, warned that layoffs at Novo Nordisk could be inevitable as the Danish pharmaceutical giant’s fierce competition against its blockbuster obesity drug Wegovy, which is in the midst of mounting pressure from rival Eli Lilly, is in decline.

Due to the drug’s declining market share and slow sales growth, especially in the United States, Novo Nordisk, which last year became Europe’s most valuable company worth $650bn thanks to Wegovy’s booming sales, is in a crucial moment.

It has warned of much slower growth this year because of shortages and the ability of compounders to create copycat drugs based on the same ingredients as Wegovy. Novo Nordisk, which has 77, 000 employees on its website, cut its annual sales and profit forecasts last week, cutting $ 95 billion from its market value.

The company, which has become one of the most popular investment stories in the world, has undergone a massive and abrupt turnaround, which has resulted in a rapid expansion of both its manufacturing and sales capabilities. The business is currently considering potential cost-savings strategies.

There are likely layoffs.

There are some places where you have to have fewer people and some places where you have to be smaller, Jorgensen told Danish broadcaster DR. “We probably won’t be able to avoid layoffs,” Jorgensen said.

However, he added that Maziar Mike Doustdar, the company’s veteran, will take over any decisions regarding layoffs when he takes office on Thursday.

According to Jorgensen, the market for copycat versions of Wegovy’s class of drugs, or GLP-1 receptor agonists, is “equal size to our business,” and we sell compounded versions of Wegovy at a “much lower price point.”

After the US Food and Drug Administration banned the compounded copies of Wegovy on May 22, Novo Nordisk said it anticipated a slowdown in compounding in the third quarter and that it anticipated the transition to branded treatments for many of the roughly one million US patients using compounded GLP-1 drugs.

However, finance chief Karsten Munk Knudsen stated on Wednesday that compounded GLP-1s are still being used by more than one million Americans and that the company’s lowered outlook has “not assumed a reduction in compounding” this year.

When asked when the company might experience negative growth in the final six months of the year, Knudsen responded that “the obesity market is volatile.” According to him, “unexpected events” would be at the bottom of the firm’s new full-year guidance range, such as “stronger pricing pressure in the US than expected.

In the second half of 2025, sales at the lower end of the range would be expected to be around 150 billion Danish krone ($23 billion), up from 157 billion krone ($24.5 billion) during the same time last year.

Knudsen reiterated that the business was working to stop unlawful mass compounding, including filing lawsuits against compounding pharmacies.

The most recent US prescription data for Wegovy, according to Jorgensen, encouraged the business. In terms of US prescriptions, the lead has decreased over the past month, despite Eli Lilly’s Zepbound’s competition being earlier this year.

Wegovy’s second-quarter sales increased by 36 percent in the US and by more than a quarter in markets outside the US, according to Novo Nordisk.

Wegovy’s US pricing remained constant throughout the quarter, but the company anticipated a larger decline in the important US market in the second half as a result of higher rebates and discounts for insurers as well as a larger share of sales expected from direct-to-consumer or cash-pay channels, according to Knudsen.

He claimed that Novo Nordisk was expanding its March-launched direct-to-consumer platform to include customers in some markets outside the US and that it may need to pursue “cash sales” directly to patients.

Cost reductions

Following last week’s profit warning, Novo Nordisk reiterated its full-year earnings expectations on Wednesday.

With the announcement that it would terminate eight research and development projects, Jorgensen stated that the company was “ensuring efficiencies in our cost base.”

We’re not sure if this is a result of a strategic re-assessment or just a coincidence, according to Jefferies analysts in a note, but it does appear to be larger than usual.

In the booming weight-loss drug market, investors have questioned whether the company can remain ahead. Since last week, several equity analysts have cut their stock price targets and recommendations.

Novo Nordisk’s stock dropped 30% last week, its worst weekly performance in over 20 years. Since the New York market opened, the stock has continued to decline. The pharmaceutical tycoon was down by more than 3.3 percent as of 12 p.m. local time (16:00 GMT).

Source: Aljazeera

Leave a Reply