President Donald Trump has strewn a number of policies over the past year that have impacted businesses, supply chains, and employment.

Despite this, the US economy appears to be expanding at a healthy rate and there is no safe harbor for unemployment.

Recommended Stories

list of 4 itemsend of list

According to experts, the reality is that the stock market boom has helped to conceal deeper economic issues.

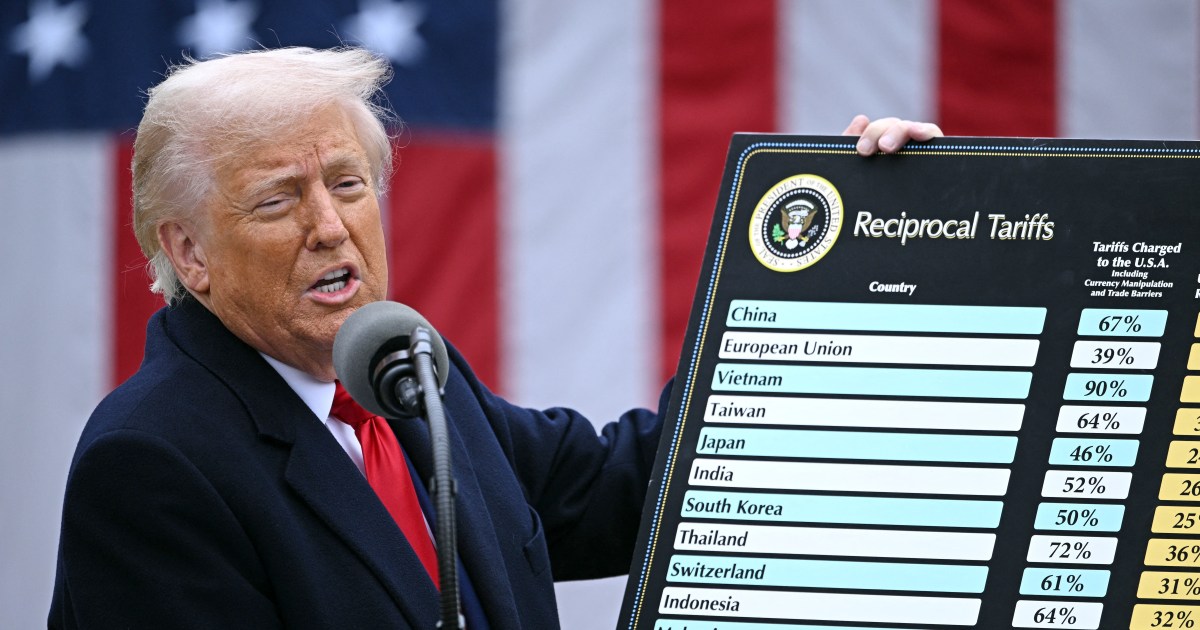

Trump has imposed a number of tariffs on various nations, including key trading partners, which has sparked fears of rising inflation, manufacturing sluggishness, and rising unemployment.

None of those scenarios actually happened.

Although inflation was above the target of the Federal Reserve, December’s inflation rate was only 2.7%.

Last month, the unemployment rate was comparatively low, at 4.4 percent. The third quarter of 2025 saw the fastest growth in two years in terms of GDP.

The “surprising and awe we anticipated just didn’t materialize,” said Oxford Economics’ lead US economist Bernard Yaros.

Yaros claimed that the limited fallout was caused by Trump’s “liberation day” dialing back of the most expensive tariffs and the relative absence of other countries’ retaliation.

The stock market, which is heavily favored by the “magnificent seven” tech companies, has increased by nearly 30% since Trump’s announcement on April 2 and has helped Americans increase their paper wealth and ease their purse strings.

In a research briefing in October, Oxford Economics reported that net wealth gains account for almost one-third of the increase in consumer spending since the COVID-19 pandemic.

The gains have also been distributed differently.

According to Moody’s Analytics, the top 10% of earners now account for roughly half of all spending, which is the highest proportion since data collection began in 1989.

According to Marcus Noland, executive vice president of the Peterson Institute for International Economics, “the gains are going a lot to people in higher income brackets – they are the ones who have the stock portfolios” and to people in fields and occupations related to AI.

However, these figures conceal the economy’s growth unevenness.

Employees’ net decline

This unevenness is revealed by careful analysis of the data. For instance, despite the impressive GDP figures, there isn’t a rise in hiring that comes with that growth.

While last year, the industries that rely heavily on immigrants added workers, such as hospitality and healthcare, have all lost jobs.

According to a Brookings Institution analysis, the US experienced negative , net migration for the first time in at least half a century as a result of the Trump administration’s widespread deportation of undocumented immigrants and tightening of legal immigration pathways.

Noland noted that the US workforce is projected to experience a net decline of two million workers this year due to their “very public and brutal way of going about deportations.”

Smaller businesses lack the resources to hold stockpile inventories or negotiate with suppliers in the face of higher tariffs, which is a “bifurcation” in the US economy that is felt everywhere.

In a report from November, Oxford Economics stated that “the increase in policy uncertainty this year has had an outsized impact on smaller firms.”

Due to the capital-intensive chip manufacturing and cloud services industry’s boom, these companies also have little to gain from the boom in the artificial intelligence (AI) sector.

There are concerns about a large number of people being laid off of work, despite AI supporters’ belief that the world is about to experience significant productivity gains that could significantly raise living standards.

“This might represent the new trend of jobless growth,” the author speculates. One of the reasons why people don’t feel so good about themselves is because of this, Yaros said.

While there is still much hype surrounding AI and the potential productivity gains, we believe that if it persists, hiring will suffer as a result.

Source: Aljazeera

Leave a Reply