After years of conflict and international sanctions, the Syrian government’s acquisition of significant oil and gas fields from the Kurdish-led Syrian Democratic Forces (SDF) in the northeast has raised hopes for the country’s crumbling energy sector to return.

Officials in Syria’s north and northeast on Sunday announced that the government forces had taken control of several oilfields, including the largest, al-Omar, and the Conoco gas complex.

Recommended Stories

list of 4 itemsend of list

As part of a ceasefire agreement, the United States-trained SDF agreed to relinquish control of the governorates of Deir Az Zor, Raqqa, and Hasakah.

As Damascus attempts to kick off production into high gear, experts predict that the government’s return of Syria’s energy reserves will mark a crucial moment for the country’s war-bombed economy.

According to Ahmad al-Dahik, an oil and gas expert from Qatar, “transitioning sovereignty into production recovery will be gradual and technically complex despite the strategic importance of regaining oil and gas assets.”

Pipelines and processing facilities require extensive rehabilitation while oil reservoirs have experienced unrestricted extraction and equipment damage. Compared to gasoline, which is typically less expensive to restore and is directly related to electricity generation, is the most likely early recovery priority.

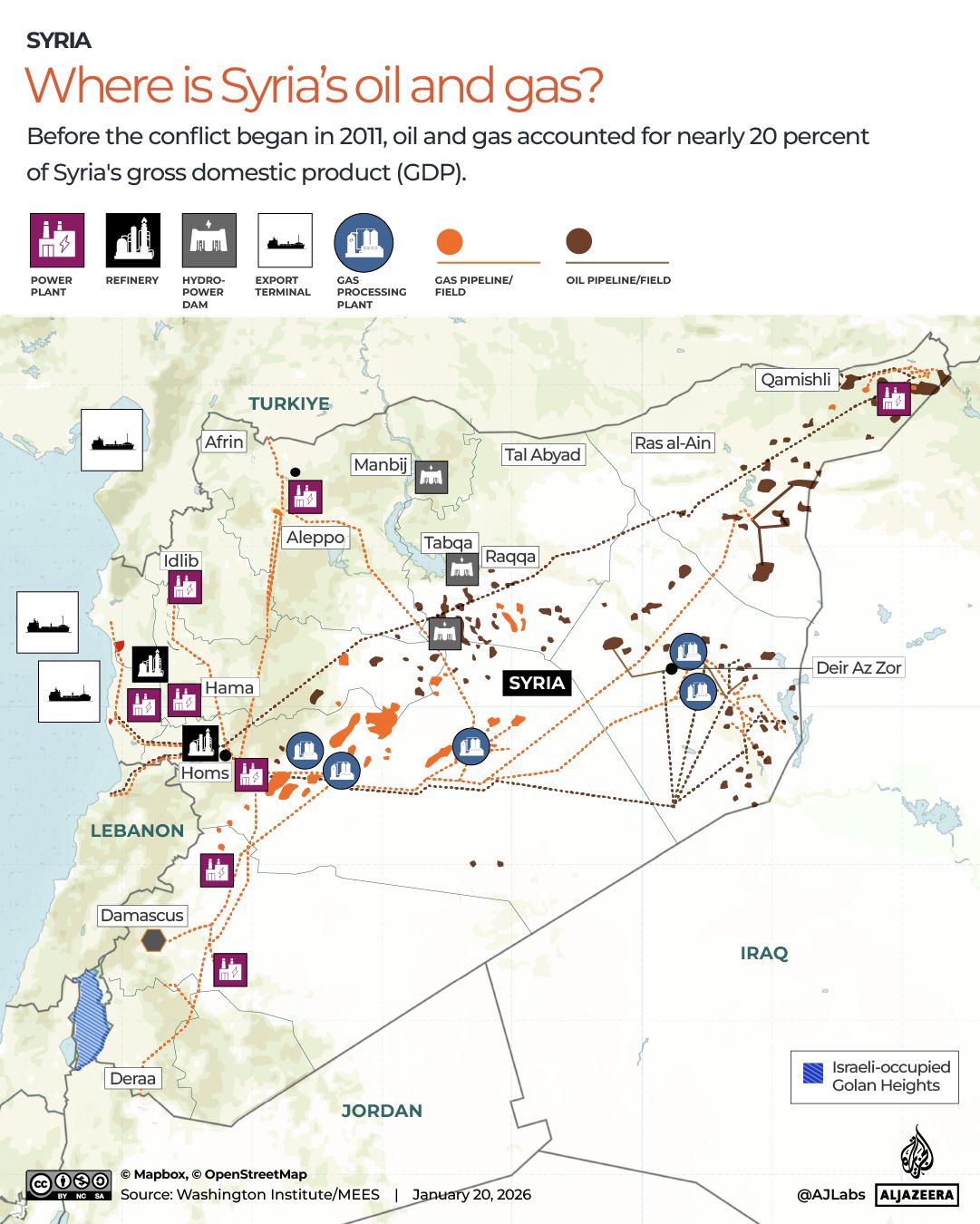

Syria’s fossil fuel reserves are enormous.

Syria’s energy sector has been in chaos since its descent into war in 2011 after a brutal crackdown on largely peaceful antigovernment protests. The country has 2.5 billion barrels of oil and 8.5 trillion cubic feet of natural gas.

Syria’s pre-war output met its domestic energy needs and generated significant revenues for the government, despite not being one of the world’s top producers of fossil fuels. The nation generates 20 to 25% of the state’s revenues by producing about 380 000 barrels of oil and about 25 million cubic meters of gas each day.

Production had fallen by about 40, 000 bpd by 2015, according to an analysis by S&, P Global Commodity Insights, when a large portion of Syria was under ISIL’s control.

According to the market analysis firm, output decreased further in 2019 after ISIL’s defeat by the SDF, which stood between 15 000 and 30 000.

Rehabilitation and new exploration are possible, but they will take time, political stability, and a set of clear-cut rules, according to Carole Nakhle, the Crystol Energy CEO.

“Government control may lead to more coordinated rehabilitation, but progress will depend on market access, expertise, and investment.”

Prospects for foreign investment

The US, European Union, and UK sanctions on Syria, which were lifted in response to al-Assad’s regime’s fall in December 2024, have sparked the possibility of more investment by foreign companies, which had a significant impact on the country’s production before it ended its war.

Syria’s single largest oil producer prior to the war was a joint venture between the state-run Syrian Petroleum Company (SPC), British multinational Shell, China National Petroleum Corporation, and India’s Oil and Natural Gas Corporation (ONGC). It had a production budget of more than one-quarter of SPC, which included more than one-quarter of SPC.

Shell had stated its intention to completely leave the al-Omar oilfield, according to SPC CEO Youssef Qeblawi earlier this week, despite the British multinational’s absence from public comment.

Prior to sanctions, France’s TotalEnergies, UK’s Gulfsands Petroleum, China’s Sinochem, and Canada’s Suncor Energy managed energy projects in Syria.

In recent months, the SPC has signed a number of preliminary agreements or memorandas of understandings with foreign energy companies, including Qatar’s UCC Holding, Saudi Arabia’s Arabian Drilling, and US-based ConocoPhillips, Dana Gas, and the UAE’s Saudi Arabia.

Syria and neighboring Turkiye reached an agreement in December to improve energy cooperation, including by restoring the gas pipeline that connects Aleppo to Kilis, Turkey’s capital.

Syrian President Ahmed al-Sharaa met with Chevron representatives in Texas last month to talk about how to contribute to the development of the nation’s energy reserves.

pivotal moment in both politics and economy

Egyptian companies like Enppi and Petrojet may also be interested in investing in the sector, according to David Butter, an analyst on Middle East at Chatham House.

According to Butter, “I anticipate the Damascus government to look for private investment in the infrastructure east of Deir Az Zor fields and to conduct tendering for some particular projects,” she told Al Jazeera.

“We could see Egyptian businesses like Enppi and Petrojet entering contracts,” said the report.

Leading companies may be reluctant to invest because of uncertainty surrounding the country’s governance and security conditions, according to Nakhle of Crystol Energy, despite the possibility of “smaller, adventurous investors.” Following new rumors of fighting, the ceasefire on Sunday hangs in the balance.

In summary, while Syria’s oil and gas sector has potential, its reconstruction will take time, be risky, and be heavily influenced by policy, security, and investment circumstances, according to Nakhle.

Al-Dahik claimed that even under favorable circumstances, it would take years for Syria’s production to return to pre-2011 levels.

Source: Aljazeera

Leave a Reply