Oil prices have increased in response to concerns that the US-Iran conflict could become a bigger conflict.

As US President Donald Trump demanded “unconditional surrender” from Tehran, the two most widely used oil benchmarks, Brent North Sea Crude and West Texas Intermediate increased, respectively, by 4.4 percent and 4.3 percent on Tuesday.

Following the increase, the benchmarks were set at $ 6.45″ and $ 4.84″, respectively.

Oil prices increased even more in early trading on Wednesday, increasing the gains by nearly 5%, before stabilizing at $ 76.37 and $ 74.83, respectively, later that day.

The benchmark S&, P500, and tech-heavy Nasdaq Composite all dropped 0.84 percent and 0.91 percent, respectively, as a result of rising geopolitical tensions overnight.

Since Friday, Israel has bombed several Iranian oil and gas facilities, including the Shahran oil depot, Fajr Jam gas plant, and the South Pars gasfield.

Although there haven’t been any significant changes to global energy flows so far, the possibility of an even greater escalation, including US military action against Israel, has skeptics on their feet.

Trump reacted more forcefully to his rhetoric against Iran on Tuesday, raising concerns that his administration might order a military strike against the country’s Fordow facility.

Trump threatened Iranian Supreme Leader Ayatollah Ali Khamenei in a thinly veiled tweet that the US knew his whereabouts but did not want him killed “for now.”

Iran’s oil reserves are the third-largest in the world, followed by its gas reserves, but sanctions from the US-led sanctions have severely restricted its ability to export energy.

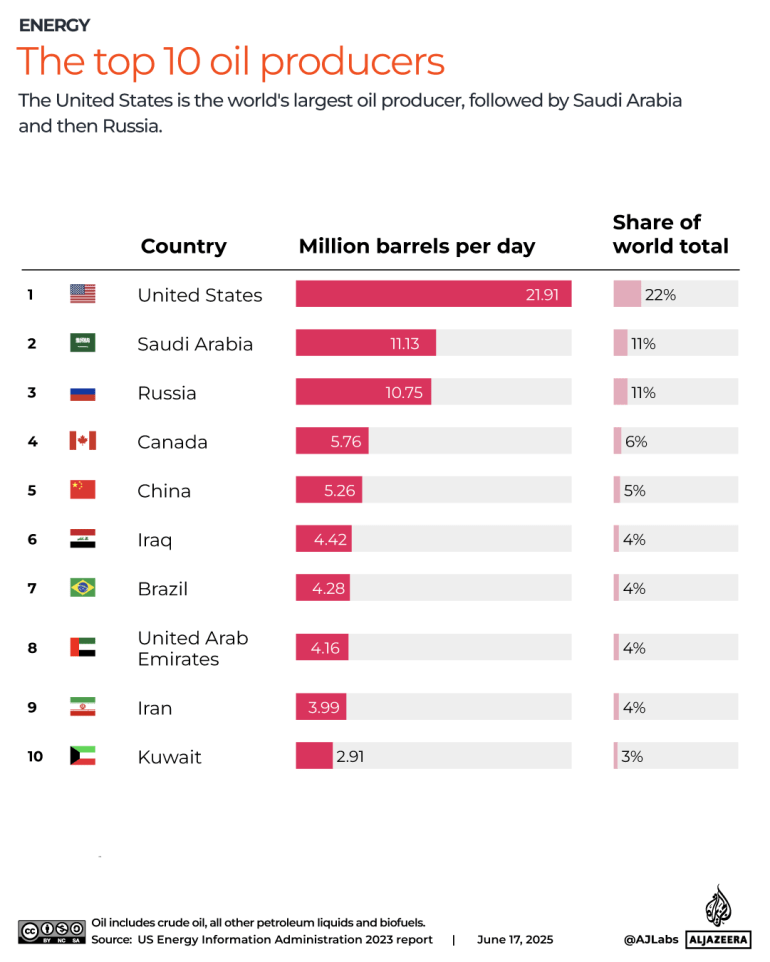

According to the US Energy Information Administration, the nation produced about 3.99 million barrels of crude oil per day in 2023, or 4% of the global supply.

Iran is also located along the Strait of Hormuz, which handles 20 to 30% of global oil shipments.

Iran’s oil exports are currently exempt from Israeli bombing thanks to the Kharg Island export terminal.

In an analysis released on Monday, Clayton Seigle, a senior fellow at the Center for Strategic and International Studies in Washington, DC, wrote that “Israel may choose to strike its oil exports in the context of its efforts to destabilize Iran,” believing that working to end a hostile regime risks alienating allies who are concerned about potential price increases.

Source: Aljazeera

Leave a Reply