According to experts, negotiations to end a ceasefire between Russia and Ukraine may soon be in progress, but Ukraine’s economic recovery won’t be as strong unless the European Union accelerates its membership and offers hundreds of billions of euros in insurance and investment, according to experts.

According to historian Phillips O’Brien, “I believe what Ukraine needs is some kind of future where it will have a stable and defendable border,” according to Al Jazeera.

Following a crucial Kremlin demand, President Donald Trump’s administration gave Ukraine and Russia a ceasefire proposal that forbade the country from joining NATO, leaving Ukraine without the security guarantees it demands.

What industry is willing to take the risk of entering that industry? posed by O’Brien. “With NATO off the table, I believe that a quick EU membership will be necessary if Ukraine wants to rebuild and be integrated into Europe.”

Although the European Commission began negotiations in record time in June, and Ukraine enjoys the support of EU heavyweights like France and Germany, membership is not guaranteed.

Ukraine would still face a depressed economy that would call for significant investment if it were to join the EU.

According to the Kyiv School of Economics (KSE), Moscow’s assault on its infrastructure had destroyed $170 billion in the first two months of its full-scale invasion, which took place in February of 2022 and November of last year.

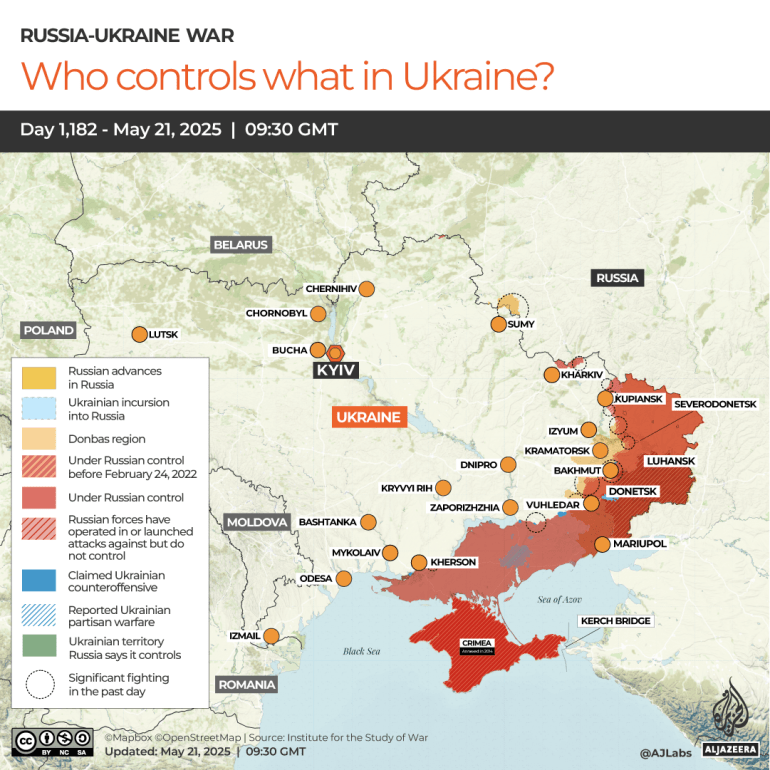

The loss of 29 percent of Ukraine’s gross domestic product (GDP) from the invasion in 2022 was not taken into account for the damage caused by the almost a decade of war in the eastern regions of Luhansk and Donetsk since 2014. Additionally, the estimate did not account for Russia’s current occupying of almost a fifth of Ukraine’s territory.

According to SecDev, a Canadian geopolitical risk firm, the region contains almost half of Ukraine’s untapped mineral wealth, which is estimated to be worth $ 12 trillion.

Additionally, some reconstruction costs, such as those incurred by chemical decontamination and mine clearing, are excluded.

The World Bank projects that reconstruction and recovery will cost about $525 billion over the course of ten years, up from $ 176 billion in this year’s figure.

The Kremlin has undoubtedly plunderned occupied territory.

According to Maximilian Hess, a risk analyst and expert on Eurasia at the International Institute of Strategic Studies, Russia’s strategy has been centered on economic war since its 2014 invasion of Donetsk and Luhansk.

Hess told Al Jazeera, “The Kremlin has undoubtedly looted occupied territory, including for coking coal, agricultural products, and iron.”

According to the KSE, Russia allegedly snatched half a million tonnes of grain, which was included in the agricultural sector’s $1.9 billion damages bill.

Russia also targeted industrial centers that were outside its control with long-range rocketry.

The Kharkiv Tractor Plant, Zaporizhia Automobile Plant, Dnipro’s Pivdenmash rocket manufacturer, and numerous other large steel plants were all left over from the Soviet Union.

In his most recent book, Economic War, Hess wrote that “all were targeted by Russian forces.” The Kremlin hoped that the attack would result in a decrease in Kyiv’s support for the country, but they also raised the cost of supporting Ukraine in the conflict. This is where Russia’s attacks were primarily intended to be.

Russia managed to rob Ukraine of its prosperous metallurgy sector through occupation and targeting.

The war resulted in a 66.5% decrease in metallurgical production, according to the US Geological Survey.

Given that Ukraine once produced a third of the region’s manganese ore, a third of its titanium, and almost a third of the iron ore in Europe, Russia, and Central Asia, that is a significant loss. Uranium, which is a significant resource in the continent’s effort for greater energy autonomy, is still the only producer of it in Europe.

A rare example of a wartime economic success story stems from Ukraine’s claims that it helped create a $20 billion defense industrial base with allied support.

Hess said that can compensate for the losses in metallurgy, “but only in some and various regions of the nation where those mining and metallurgical losses were concentrated. It will be necessary to promote metallurgical activity in places like Kryvyi Rih, Dnipro, Zaporizhzhia, and ideally, territory that is ultimately free of Russian occupation.

Trump’s minerals deal and other instruments

A memorandum of intent to mine the country’s mineral wealth was signed by Ukraine and the US a few weeks ago.

Experts doubted the idea that mineral wealth could help rebuild Ukraine, despite the country’s commitment to putting half of the proceeds from its metallurgical activities into a Reconstruction Fund.

The KSE Institute’s head of strategic projects, Maxim Fedoseienko, stated to Al Jazeera, “Projects have a long launch period… from five to ten years. You need three years to build this mine, and you also need to conduct an environmental impact assessment and documentation.

Because “we have more than 24 kinds of materials from the EU list of critical]raw materials,” the US and EU might invest in these mines, Fedoseienko said, but they would only make an equitable investment.

Trump referred to the minerals deal as reversing the military’s billions.

Nothing about it is even remotely fair. O’Brien claimed that the aid was not being returned.

It is unfair if everyone says, “OK, we will help you in a time of war, so you are owned by] us,” as Fedoseienko put it.

Ukraine requires money in addition to fairness. That also requires insurance in some cases.

For instance, a state-backed war-risk insurance agreement Kyiv and the United Kingdom reached in 2023 that reintroduced bulk carriers into Ukrainian ports and defeated Russian attempts to obstruct Ukrainian grain exports.

In consequence, according to the agriculture ministry, Ukraine exported 57.5 million tonnes of agricultural products between 2023 and 2024, and was on track to export 77 million tonnes in the same period until 2024-2025.

Hess argued that “there needs to be a significant expansion of public insurance products specifically and a move to seize frozen Russian assets.”

Although it was deemed controversial to seize $300 billion in EU funds, the initiative is now popular.

O’Brien claimed that the Russian state has committed these war crimes and broken international law by causing this harm to Ukraine, which ultimately serves as a justification for helping Ukraine recover. “Europeans have a very strong argument against this, but they lack the political will to do it right now.”

Volodymyr Zelenskyy, the president of Ukraine, has asked Europe to use the funds for its defense and reconstruction on numerous occasions.

What the Europeans have accomplished thus far has had an impact on the reconstruction of Ukraine.

Every year, about $300 million in interest payments made from Russian assets are diverted to reconstruction.

A program funded by the European Commission offers financial assistance worth 9.3 billion euros ($11.05 billion) to encourage private sector investment.

Ukrainian banks are given loan guarantees by financial institutions like the European Bank for Reconstruction and Development, which provides them with liquidity.

“So Ukrainian banks can loan Ukrainian businesses to invest and run in Ukraine. This is a significant ecosystem that can support economic investment and operational needs in Ukraine, Fedoseienko asserted.

The KSE runs an online portal that provides information on the various instruments available, which has already resulted in the successful completion of 165 investments worth $ 27 billion, in collaboration with the finance ministry.

Source: Aljazeera

Leave a Reply