Eli Lilly’s $1 trillion market value highlights its rise as a weight-loss powerhouse and makes it the first drugmaker to enter the exclusive club dominated by tech giants.

The weight-loss drug market’s explosive growth, which added it to the $1 trillion club on Friday, largely contributed to the company’s more than 35 percent increase in stock this year.

Recommended Stories

list of 4 itemsend of list

Obesity treatments are now one of the most lucrative medical fields, with steadily rising demand, and were once seen as a niche industry.

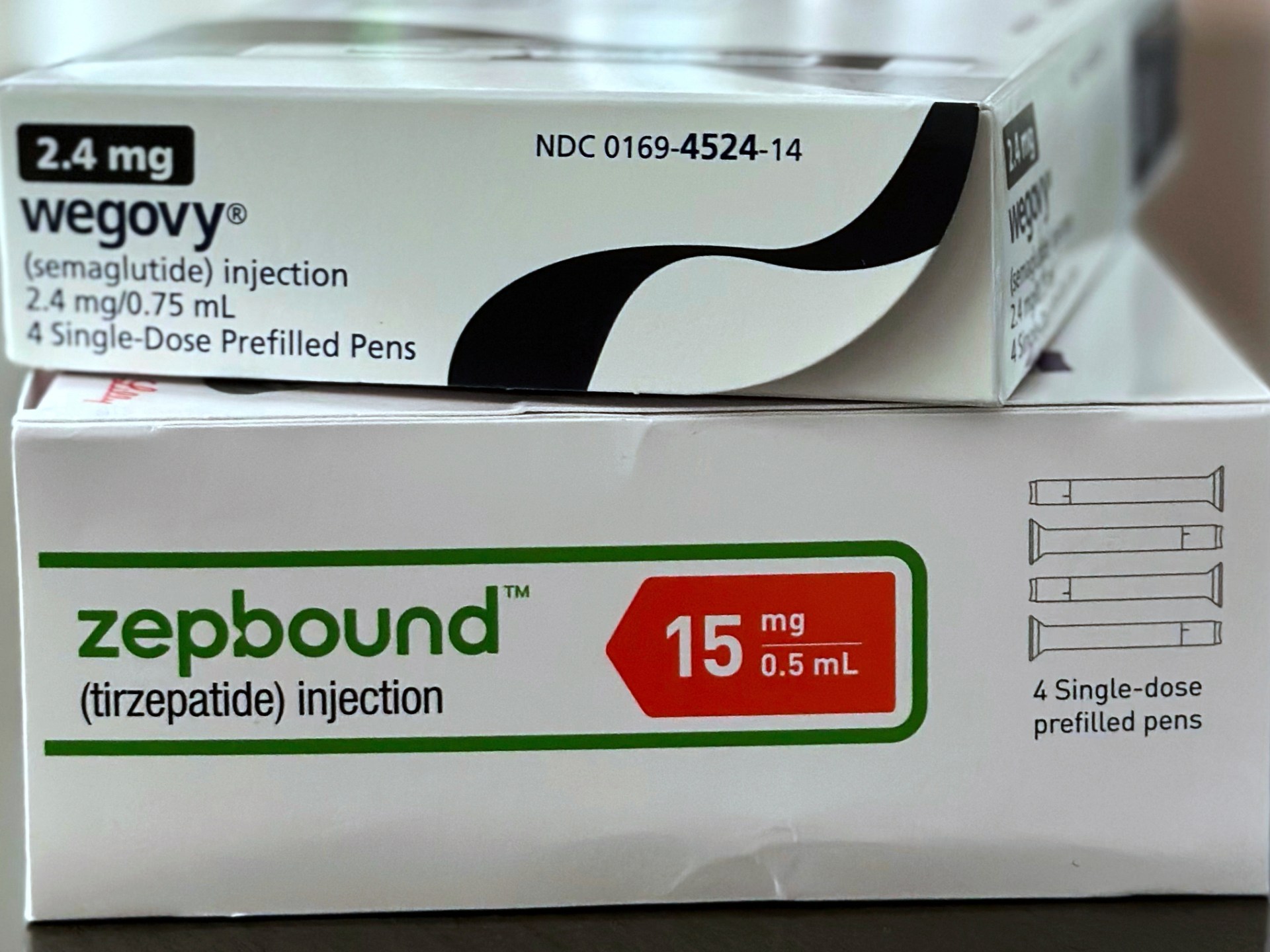

Although Novo Nordisk held the early position in the space, Lilly’s products, Mounjaro and Zepbound, have gained a lot in popularity and helped it surpass its closest competitor in terms of prescriptions.

The company’s stock increased by 1.3 percent to close at a record high of $ 1,057.70.

According to LSEG data, Lilly currently trades at one of the richest valuations in big pharma, accounting for about 50 times its anticipated earnings over the next year, reflecting investors’ confidence that the demand for obesity medications will continue to be strong.

The overall US equity market has far outperformed the market for shares. Since the launch of Zepbound in late 2023, Lilly has increased by more than 75%, compared to the S& and P 500’s increase of more than 50% in the same time.

More than half of Lilly’s total revenue, $ 17.6 billion, came from its obesity and diabetes portfolio, which generated more than $ 10.09 billion in the most recent quarter.

Before the milestone, Lilly shareholder Bahl and Gaynor’s CEO Kevin Gade said, “They are doing so many things outside of obesity, but I don’t know if that would be a factual statement.

“Resales phenomenon”

By 2030, according to Wall Street, the weight-loss drug market will be worth $150 billion, with Lilly and Novo jointly accounting for the majority of the global sales.

Orforglipron, a Lilly oral obesity drug, is currently attracting the attention of investors because it is anticipated to be approved in the first quarter of this year.

According to Citi analysts, the most recent generation of GLP-1 drugs have already been a “sales phenomenon” and that orforglipron could benefit from the “injections made by its predecessors” in a note last week.

Lilly’s recent agreement with the White House to lower the cost of its weight-loss medications and make future investments to increase its growth are encouraging.

According to James Shin, director of Biopharma Equity Research at Deutsche Bank, Lilly is starting to resemble the “Magnificent Seven” once more. The seven tech giants, including Microsoft and Nvidia, account for the majority of the market’s returns this year.

Investors once saw it as a member of that elite group, but after some unfavorable headlines and earnings, it lost favor.

However, given recent concerns and weakness in some AI stocks, he continued, it appears poised to circle back and possibly even as an alternative for investors.

Share this:

Related

Source: Aljazeera

Leave a Reply