China has accused Nvidia of violating the country’s anti-monopoly law, the latest escalation in its trade war with the United States that has claimed the US-based chipmaker as collateral damage.

The allegation by China’s market regulator on Monday was made after what it said was a preliminary probe into Nvidia’s business practices, and comes as the two countries held trade talks in Madrid, Spain, where chips were expected to be on the agenda.

Recommended Stories

list of 4 itemsend of list

US Treasury Secretary Scott Bessent called the announcement from China’s State Administration for Market Regulation (SAMR) “poor timing”, a move analysts said gave China leverage in the trade talks.

The two countries have traded barbs over the past six months since US President Donald Trump hit China with massive tariffs, before lowering them to 30 percent, and threatened to shut down popular social media app TikTok.

China has responded with 10 percent tariffs and antitrust probes against the likes of Alphabet’s Google, signalling more regulatory scrutiny on US firms.

“It’s a warning that if the US export control paradigm operates in the same way as in the past several years, there will be consequences, and China is willing to inflict damage on US companies,” said Zhengyuan Bo, partner at research company Plenum.

He added that SAMR’s preliminary ruling was likely a counter to the Trump administration’s decision on Friday to place 23 Chinese companies on a US trade blacklist.

China’s announcement piles on more uncertainty for Nvidia’s business in China, which last year accounted for 13 percent of its total sales.

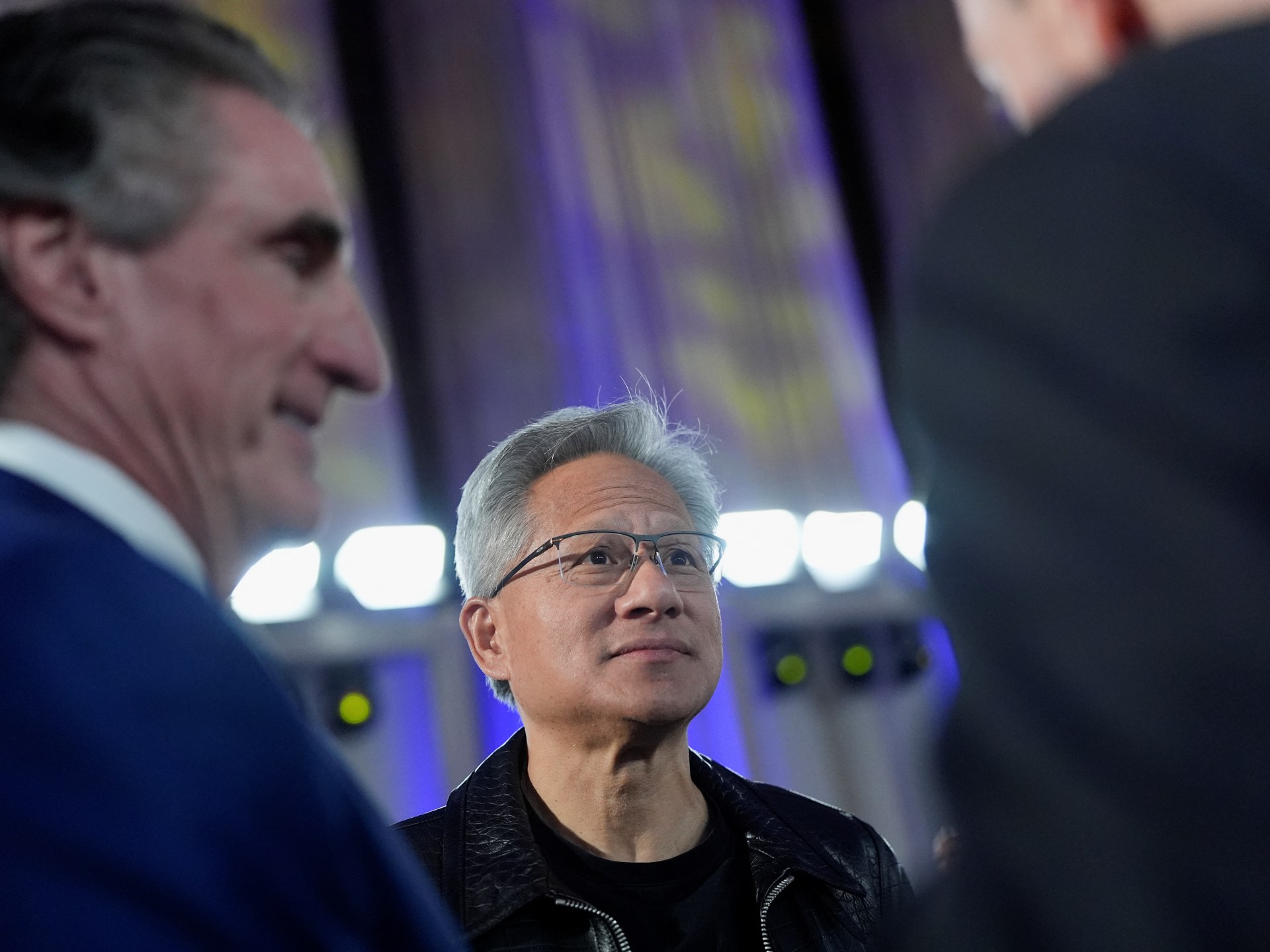

It shows that CEO Jensen Huang’s charm offensive in China is not enough. Huang visited the country three times this year to signal his commitment to the Chinese market, and has said that selling AI technology to China is key to US ambitions to be a leader in the business.

Despite big demand from Chinese tech firms including Tencent and TikTok parent ByteDance for Nvidia’s chips, which are needed to build out infrastructure for soaring AI workloads, the Reuters news agency has reported that China has discouraged the firms from such purchases as it tries to wean itself off US technology.

Beijing last month also asked Nvidia to explain whether its H20 chip, made specifically for the Chinese market, posed backdoor security risks that could affect Chinese user data and privacy.

Even after the US authorised export licences allowing Nvidia to sell H20 chips in exchange for 15 percent of its sales in the country, the chipmaker has not sent any H20 chips to China because the US has yet to come up with rules on how to get the payment.

Nvidia said in a statement that it was complying with the law and would “continue to cooperate with all relevant government agencies as they evaluate the impact of export controls on competition in the commercial markets”.

The company declined to comment further on where it stood with the US government on paying the 15 percent share of its China revenue. The US Department of Commerce and the White House did not immediately respond to requests for comment.

Separately, Bessent said on Monday that the two countries have reached a framework to switch TikTok to US-controlled ownership, the second time this year that they have come close to a deal.

Nvidia’s competitive edge

The brief statement by China’s SAMR on Monday did not elaborate on how Nvidia might have violated China’s anti-monopoly laws. Under those rules, companies can face fines of between 1 percent and 10 percent of their annual sales from the previous year.

China in 2020 had approved Nvidia’s deal to buy Israel’s Mellanox Technologies with the condition that Nvidia would continue to supply the Chinese market with high-tech GPU chips. But the company was forced to end sales of its most advanced chips due to export controls implemented by the administration of former US President Joe Biden.

Regulators said in December that they were investigating the company for suspected violations stemming from the $6.9bn acquisition of Mellanox.

The SAMR on Monday added that it would continue its investigations.

Mellanox makes high-speed networking equipment for data centres, and Nvidia bundles them with its chips to offer advanced cloud-computing products.

“The real concern is the potential for China to impose new measures restricting Nvidia’s ability to sell networking solutions to Chinese customers,” said Ray Wang, lead semiconductor analyst at Futurum Group. “This business is worth billions of dollars annually and continues to grow alongside rising demand for networking in data centres.”

Wang added that the Mellanox gear played a “very important role, second to CUDA”, Nvidia’s computing platform, in allowing the firm to provide the best networking technology in the world.

Lian Jye Su, chief analyst at consultancy Omdia, said Nvidia could be required to sell chips in China unaccompanied by Mellanox’s technology.

Still, an unfavourable ruling for Nvidia on the antitrust probe was unlikely to affect Nvidia’s bottom line as much as China’s efforts to foster domestic substitutes to the US chipmaker’s most powerful AI chips, Plenum’s Bo said.

“This should not be taken as a sign that China is trying to kick Nvidia out of the country,” he noted.

Source: Aljazeera

Leave a Reply