Video from Tehran showed a huge explosion in Iran’s capital as US and Israeli air attacks continued. Al Jazeera’s Tohid Asadi is there.

Huge explosion seen in Tehran as strikes on Iran continue

Video from Tehran showed a huge explosion in Iran’s capital as US and Israeli air attacks continued. Al Jazeera’s Tohid Asadi is there.

Russia has called for a “cessation of hostilities” in US President Donald Trump’s “aggression against Iran”, after the United States and Israel launched unprovoked, coordinated attacks against the Islamic republic on February 28.

Russian Foreign Minister Sergey Lavrov offered mediation in the conflict, while Russian President Vladimir Putin expressed “deep concern”.

list of 4 itemsend of list

But as a new war rages, the Russia-Ukraine conflict has barrelled into a fifth year with little sign of peace on the horizon.

On February 27, Russian forces escalated their offensive by shelling outlying communities of Kramatorsk, a city in Ukraine’s eastern Donetsk region, Russia has claimed.

It was “the first time that Russian forces have hit Kramatorsk or its suburbs with tube artillery,” said the Institute for the Study of War (ISW), a Washington-based think tank.

Kramatorsk is one of four cities, along with Sloviansk, Druzhkivka and Kostiantynivka, forming a “fortress belt” running from north to south, in whose defence Ukraine has heavily invested.

Putin has demanded the surrender of the fortress belt as a condition for a ceasefire.

Zelenskyy told reporters on Monday that he had seen leaked documents of Russian war plans, and they included seizing the unoccupied parts of Donetsk and neighbouring Luhansk in an offensive beginning this month.

Also in Putin’s war aims is the seizure of the southern port city of Odesa and swathes of Zaporizhia and Dnipro, which would place Russian troops deeper into central Ukraine.

But the fight is not going well for Russia, according to Ukrainian commander-in-chief Oleksandr Syrskii.

“In February 2026, for the first time since the Kursk offensive operation, the Ukrainian Defence Forces regained control over a larger territory than the enemy was able to seize,” he wrote on the Telegram messaging service. “We are holding our ground,” he said.

The Kursk offensive, masterminded by Syrskii, counter-invaded Russian territory in August 2024 and took Russia by surprise.

The ISW agreed with him, estimating Ukraine had made net gains of 257sq km (100 square miles) this year. The last time Ukrainian forces made net gains on their own territory was during a 2023 counteroffensive, said the ISW, estimating those gains at 536sq km (205 square miles).

“They cannot launch the March offensive,” Zelenskyy told reporters. “They want to attack, but they don’t have the strength to do it yet.”

Syrskii said, “The total losses of the Russian invaders over the three winter months amount to about 92,850 soldiers killed and wounded, or 1,031 people per day.”

Ukraine also scored a range of fire victories in the past week.

An estimated 200 Ukrainian unmanned aerial vehicles struck the Russian Black Sea Port of Novorossiysk on Monday. Video showed them blowing up an oil terminal and damaging six of seven tankers moored there. They also damaged jamming and radar systems on the frigate Admiral Essen, and damaged the minesweeper Valentin Pikul and the anti-submarine warfare corvettes Yeysk and Kasimov.

On the same night, Ukraine struck the Albashneft oil refinery in Krasnodar Krai. The attack destroyed several fuel tanks and pipelines.

Two days later, Russia accused Ukraine of sinking its liquefied natural gas (LNG) carrier Arctic Metagaz off the coast of Libya by launching unmanned surface drones from the Libyan coast. The ship caught fire and sank along with 61,000 tonnes of LNG, 240km (150 miles) off Sirte.

Russian condemnation of the war in Iran and offer to mediate mirror Trump’s call for Russia’s conflict of aggression against Ukraine to end and his attempts to launch negotiations.

Ukraine’s allies have repeatedly described Russia as a rogue state for ignoring UN rules to negotiate differences peacefully, but Lavrov turned the tables on the US.

“The United States has stated openly, and President Donald Trump has said it without hesitation, that it will not be guided by any UN principles. It will be guided only by the interests of its own state,” Lavrov said at a news conference on Tuesday.

Putin told Gulf leaders in a phone call on the same day that Russia “respects the sovereignty of other countries and does not interfere in other people’s affairs”, as his troops fought for territory in Ukraine.

While most US allies have distanced themselves from Trump’s Iran war, Ukraine encouraged it.

“It is fair to give the Iranian people a chance to rid themselves of a terrorist regime … and to guarantee security for all nations that have suffered from terror originating in Iran,” Zelenskyy said on Saturday.

He was referring to the “more than 57,000” Shahed-type drones designed by Iran and sold to Russia, or produced in Russia under licence, that have been launched against Ukraine.

Iran has provided lethal assistance to Russia during the Ukraine war, and the two signed a Comprehensive Strategic Partnership in January 2025.

As Iran launched drones and missiles towards its Gulf neighbours, Ukraine offered to help them defend themselves.

British Prime Minister Keir Starmer took up the offer to help its partners in the Middle East.

“We will … bring experts from Ukraine to partner with our own experts to help Gulf partners shoot down Iranian drones attacking them,” Starmer said.

“Ready to help and share our experience!” wrote Oleksandr Kamyshin, Zelenskyy’s key adviser on international defence production agreements.

“Ukraine has 10+ companies producing interceptor systems. We intercept around 90 percent of Russian Shaheds, largely with interceptor drones,” he wrote.

New video released by the Sri Lankan navy shows Iranian sailors being rescued after a US submarine attack sank their ship in international waters.

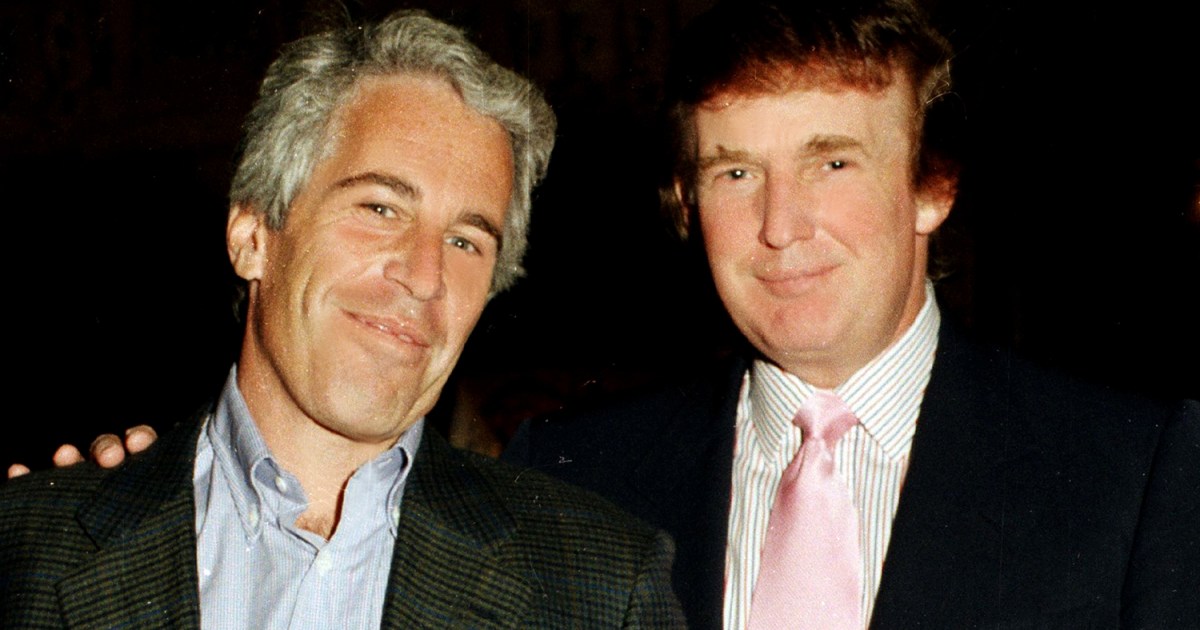

The United States Justice Department has published additional FBI documents, describing interviews with a woman who said President Donald Trump sexually assaulted her when she was a teenager after she was introduced to him by late convicted sex offender Jeffrey Epstein.

The documents had not been made public under previous congressionally mandated file releases related to Epstein, the disgraced financier, because they were mistakenly marked “duplicative”, the department said on Thursday.

list of 4 itemsend of list

Democrats are investigating the Trump administration’s handling of the Epstein files.

The documents released on Thursday include descriptions of multiple 2019 interviews the FBI held with the woman, who alleged she was assaulted by Epstein and Trump while she was aged between 13 and 15 years old.

In one interview, the woman said Epstein took her to “either New York or New Jersey” and introduced her to Trump. She told investigators that she bit Trump as he attempted to force her to perform oral sex on him.

The woman said she and people close to her received threatening calls over the years demanding she keep quiet, which she believed were related to Epstein.

FBI records reportedly suggest agents stopped speaking with her in 2019. In the report of the woman’s final interview, conducted in October 2019, during Trump’s first presidency, agents asked whether she would be willing to provide more information about Trump.

In response, the agent wrote, she “asked what the point would be of providing the information at this point in her life when there was a strong possibility nothing could be done about it”.

Politico, the US publication which first reported the disclosures, said White House press secretary Karoline Leavitt called the woman’s claims “completely baseless accusations, backed by zero credible evidence”.

Trump has denied any wrongdoing related to the Epstein allegations, and the Justice Department previously said some of the documents it has released “contain untrue and sensationalist claims against President Trump”.

Before the US and Israel launched their war on Iran five days ago, the fallout from files released by the US Department of Justice on the convicted sex offender Jeffrey Epstein was reverberating around the world.

But all those revelations have sharply shifted once the bombs started raining down on Iran.

On Sunday, Republican US Congressman Thomas Massie, who helped push the passage of the Epstein Files Transparency Act through Congress last year, said, “bombing a country on the other side of the globe won’t make the Epstein files go away”. He has also been critical of the war.

Shaiel Ben-Ephraim, an analyst with Atlas Global Strategies and a former Israeli diplomat, has told Al Jazeera that Trump “really needs a distraction from [his domestic issues] in the form of a war”.

Nearly a week into the United States-Israel war on Iran and the BRICS bloc, a multi-country alliance that includes Tehran, has not reacted in any form to the conflict.

To analysts and political observers, that seems out of character. When the 12-day war between Israel and Iran broke out in June last year, the bloc, which Brazil then chaired, was quick to state that US-Israeli joint attacks on Iran were a “violation of international law”.

list of 4 itemsend of list

However, since the chairmanship of BRICS shifted to India in December 2025, New Delhi’s own interests appear to be overriding the alliance’s objectives, critics say, as India signals closer ties with Israel and the US.

The 11-member BRICS grouping was formed as an economic alliance in 2009 and is widely regarded as a “Global South” alternative to the exclusive Group of Seven (G7) alliance of industrialised economies.

US President Donald Trump once accused its members of being “anti-American”, although BRICS has said it does not see itself as competing with or countering any other groups.

In recent years, the organisation’s mandate has broadened to include security issues, with members conducting joint military drills – most recently hosted by South Africa in January this year, when India opted out.

BRICS is named after the first letters of its founding members: Brazil, Russia, India, China, and South Africa. Since 2024, BRICS has expanded to include Indonesia, Ethiopia, Egypt, Iran, Saudi Arabia and the United Arab Emirates.

Here’s what we know about how India’s interests may have come into conflict with those of other BRICS nations:

The organisation itself, under Indian leadership in 2026, has not commented directly about the US-Israeli Operation Epic Fury in Iran, which has seen multiple missile and drone attacks across the country, killing more than 1,230 people in its first six days.

However, individually, three of its five founding members have issued statements commiserating with Iranians mourning loved ones and denouncing violations of international law.

South Africa’s President Cyril Ramaphosa, whose administration is embroiled in a dispute of its own with the US over the Trump-alleged, but debunked, “genocide” of white South Africans, voiced concerns about the conflict on Wednesday and warned that the fighting could go beyond the Middle East.

“We want a ceasefire, we want this madness to come to an end,” Ramaphosa told reporters, three days after his African National Congress party first issued a statement “condemning” the US and Israel’s “anticipatory self-defence based on assumption or conjecture”.

South Africa, Ramaphosa added on Wednesday, is also ready to play a mediator role to help resolve the issue and end the loss of lives. The country came in for heavy US criticism earlier in January when Iran was allowed to participate in the BRICS naval drills hosted by South Africa, amid reports of massacres of Iranian protesters.

Russia’s President Vladimir Putin similarly criticised the joint US-Israel attacks and the killing of Iranian Supreme Leader Ayatollah Ali Khamenei in strikes on Saturday, in a letter to President Masoud Pezeshkian. Moscow and Tehran have close ties, with Russia providing weapons and weaponry to Iran. However, Moscow has not indicated any willingness to intervene militarily to support Iran.

Speaking at a news conference on Tuesday, Russia’s Foreign Minister Sergey Lavrov said there was no evidence that Tehran is developing nuclear weapons – a key issue for the US and Israel – and that the war could lead to the very outcome the two allies claimed they wanted to prevent: Nuclear proliferation across the region.

As the bombs dropped on Iran last Saturday, Russia’s Ministry of Foreign Affairs accused the US and Israel of “premeditated and unprovoked acts of armed aggression against a sovereign and independent UN member state”.

Moscow itself stands accused of aggression against a sovereign nation, amid its fifth year of war on Ukraine.

Meanwhile, China’s Foreign Minister Wang Yi told Gideon Saar, his Israeli counterpart, over the phone on Tuesday that Iran had been attacked as negotiations between Washington and Tehran “made significant progress, including addressing Israel’s security concerns”, China’s Ministry of Foreign Affairs said in a statement.

Wang added that China “opposes any military strikes launched by Israel and the US against Iran”, according to the Foreign Ministry.

Of the founding members, only India has not outrightly condemned the US-Israel attacks on Iran. Under its chairmanship of BRICS, the organisation has also been unusually silent on the war.

On Tuesday, three days after the first attacks hit Tehran, killing Khamenei and several of Iran’s senior military officials, New Delhi made cautious calls for an “early end to the conflict” in a statement by the country’s Ministry of External Affairs.

“India strongly reiterates its call for dialogue and diplomacy. We share our voice clearly in favour of an early end to the conflict,” the ministry said, adding that the war risked regional stability and the safety of thousands of Indian nationals living and working in the Gulf region.

Prime Minister Narendra Modi also spoke to Gulf countries and criticised retaliatory attacks on their territories, without mentioning Iran.

Critics, especially from the Indian opposition Congress party, have called out Modi’s lack of outright denunciation of the Israeli-US attacks and the killing of Khamenei, especially in light of Modi’s visit to Israel, during which he addressed the Knesset in Jerusalem, just days before the war began.

The timing of the visit gave the appearance of “tacit approval” of the attacks on Iran, the party said on Monday.

Modi undertook a state visit to Israel on February 25 and 26, 2026. He met with Israel’s Prime Minister Benjamin Netanyahu, who is wanted by the International Criminal Court (ICC) on suspicion of war crimes related to Israel’s onslaught on Gaza.

Addressing the Knesset, Modi affirmed that “India stands with Israel, firmly, with full conviction, in this moment and beyond,” even as Israel has come under fire globally for the genocidal campaign in Gaza and deadly attacks by Israeli forces and settlers in the occupied West Bank.

Modi and Netanyahu went on to sign several trade agreements on defence and artificial intelligence, areas in which they have long collaborated. Israel also sends about 40 percent of its arms exports to India.

In a post on X, Modi wrote that the two countries had elevated “our time-tested partnership to a Special Strategic Partnership” during his visit.

About the same time, the threat of Israel-US attacks on Iran was looming. Modi may even have known about the attacks, one former Indian diplomat told Indo-Pacific-focused The Diplomat magazine.

The Modi government has not responded to this allegation.

Reuven Azar, Israeli ambassador to India, told local publication The Indian Express on Wednesday that the opportunity to launch the joint attacks on Iran came “only after Prime Minister Modi left”.

India has long championed a stance of strategic autonomy, allowing it to trade with Western countries while also deepening ties with countries viewed in the West as pariah states, such as Russia. That is part of the reason it was a founding BRICS member.

A tense standoff arose with the administration of US President Donald Trump over India’s continued purchase of sanctioned Russian oil last year. Trump imposed sweeping import levies of up to 50 percent on India in August 2025, partly as punishment for this. India, whose largest trading partner is the US, described the additional tariffs as “unfair, unjustified, and unreasonable”.

The tariffs threatened to destabilise about 70 percent of India’s exports to the US, the country’s research council warned afterwards, urging quick trade reforms. India majorly exports electronics, pharmaceuticals, and jewellery to the US.

By February, the picture had changed. Following talks, Trump announced an agreement with India that slashed tariffs to 18 percent as he claimed that Delhi had agreed to stop buying Russian oil and to instead buy more US oil and other products.

“Big thanks to President Trump on behalf of the 1.4 billion people of India for this wonderful announcement,” PM Modi wrote on the X social platform in response.

When President Trump first took office, he threatened BRICS countries with an additional 10 percent tariff as part of his trade war.

Then, in July, he took aim at the group again before its annual summit, saying: “When I heard about this group from BRICS, six countries, basically, I hit them very, very hard. And if they ever really form in a meaningful way, it will end very quickly.”

While India has continued to participate in routine BRICS meetings in recent months, it has notably stayed away from security issues.

In January, when BRICS countries met in South Africa to hold military drills, New Delhi was absent, although it was already the group chair at the time. India gave no reasons why. Brazil, which faced US tariff problems of its own, also chose not to participate, but was present as an observer.

Opting out for India was “about balancing ties with the US”, Harsh Pant, a geopolitical analyst at the New Delhi-based think tank Observer Research Foundation, told Al Jazeera at the time.

Fellow BRICS member China has similarly faced a gruelling trade war with the US, but has spoken up in support of Iran.

Some critics fault Beijing for not directly intervening in the war to support its ally. However, Dong Wang, a professor of international studies at Peking University, said those expectations misunderstand China’s position.

“China advocates mediation, not military involvement,” he said.

Comparing Beijing’s response to Delhi’s, the professor said India was choosing a “cautious, balanced posture emphasising de-escalation”.

But the differing responses from BRICS nations, he added, reflect a need for its members to come to a consensus even as they hold diverse ties and strategic priorities.

Such a consensus will be needed if the group continues to stand, and its existence is something Beijing takes seriously, Wang said.

“From China’s perspective, BRICS unity matters, and differences are normal within a diverse multilateral framework,” he said.

The United States-Israeli military strike against Iran on February 28, 2026, was not merely another episode in the region’s long cycle of tensions. That attack quickly transformed into a pivotal event with the announcement of the assassination of Iranian Supreme Leader Ali Khamenei, a development that disrupted the balance of power within the regional axis Tehran had built over decades.

In Yemen specifically, a different question arose: how will Abdel-Malik al-Houthi deal with this moment? Will these developments push the group to engage in a new confrontation, or will it choose to manage the situation cautiously and wait for the conflict’s trajectory to become clear?

And what will be the fate of the group and its leadership if it decides to wage this war?

In Sanaa, where the Houthi group is politically and ideologically linked to the Iranian axis, it was natural for attention to turn to the speeches of the group’s leader.

Abdel-Malik al-Houthi has appeared three times since the outbreak of the war. In his first speech, he declared his solidarity with Iran and affirmed his readiness for “all developments,” in a message that seemed more like a political statement than a declaration of military resolve. In the second speech, the tone was more emotional, offering condolences for Khamenei’s death and reaffirming support for Tehran.

The third speech was similar, without any different pronouncements, and reinforced the same message.

However, what was left unsaid in the speeches was as striking as what was said.

The group did not issue a clear declaration of military intervention, as it had done in the past when it wanted to send messages of deterrence or practical solidarity with its allies. Nor were there any direct escalations or clear military threats against Israeli or US interests recorded on the ground. Even the group’s media messaging appeared more disciplined and subdued this time, unlike its usual approach in similar regional moments, which typically featured widespread escalatory rhetoric.

This discrepancy between the mobilisation rhetoric and the actions on the ground suggests that the decision to go to war is not as simple as it seems. The group, which has built a large part of its political discourse on the idea of the “axis of resistance,” is also aware that entering into a direct confrontation at a highly complex regional juncture could open a Pandora’s box with uncontrollable consequences.

Comparing this with the behaviour of the other members of the axis reveals a clearer picture. Hezbollah in Lebanon, one of Iran’s most important military proxies in the region, wasted no time in entering the fray after the outbreak of the latest war. The party’s entry into the conflict reflects its role within what is known as the Iranian axis, where it is seen as one of the most important regional deterrents and among the most ready for rapid military action should Tehran come under direct attack.

This development reinforces the impression that Iran has already begun activating some of its military proxies in the region. With Hezbollah and Iraqi factions now engaged in the conflict, the question of the Houthis’ position becomes even more pressing: will they remain on the sidelines, or will they join the fray later if the war escalates?

The Houthi situation appears somewhat different. Despite its close ties to the Iranian axis, the group operates within a different geographical and political environment and faces complex internal and regional considerations that make any decision to enter the war more delicate. Therefore, the restraint evident in its current behaviour may reflect an awareness that any large-scale escalation could open multiple fronts against it at a time of regional instability.

Recent experience also reveals that the Houthis are capable of a degree of pragmatism when circumstances dictate different calculations. In May 2025, the Sultanate of Oman brokered an agreement between the group and the US that reduced tensions in the Red Sea, following months of heightened tensions stemming from Houthi attacks on international shipping. This agreement reflected the group’s willingness to readjust its military behaviour when the cost of escalation outweighed its potential gains, especially given the heavy price they paid from US air strikes in 2025.

During the 12-day war in June 2025, a sensitive regional moment, the Houthis confined themselves to rhetoric of solidarity rather than direct military intervention, despite the moral pressure exerted within the Iranian axis. These precedents indicate that the group possesses the ability to separate its mobilisation rhetoric from its operational decisions when cost-benefit considerations take precedence.

Therefore, the most likely scenario – should the regional war continue for an extended period – appears to be a calculated escalation through symbolic operations or carefully calibrated pressure tactics, without engaging in a full-scale confrontation. Such an option would give the group room to demonstrate solidarity with Iran and maintain the cohesion of its internal base, without provoking a large-scale strike that could target its military infrastructure at a time of regional instability.

In this context, there is another equally important possibility: that the group will postpone its direct intervention but seek to support Iran through a different front, such as the Red Sea and the Bab al-Mandeb Strait. This region represents one of the most important strategic pressure points on global trade and energy routes, and the Houthis have proven in recent years their ability to use it as an effective pressure tactic by targeting or threatening shipping.

Such a scenario could allow the group to participate in the confrontation indirectly, by disrupting international supply lines and sending a political and military message simultaneously, without engaging in open conflict with Israel. It also aligns with the role the Houthis have played in recent months, when the Red Sea attacks became part of the regional pressure equation linked to the war in Gaza.

Direct intervention, whether through bombing Israel or carrying out large-scale operations against American interests, remains a high-risk option, especially given growing assessments that Israel has considered the Houthis a deferred target for months, and that any opportune moment could be exploited to launch a broad strike against its leadership and military infrastructure.

The group’s calculations are not limited to the regional arena; the internal dynamics in Yemen play an equally influential role in determining its choices. It understands that any broad involvement in an external confrontation could open the door to unpredictable internal shifts, particularly amid efforts to rearrange the balance of power within the government camp and attempts to reorganise military decision-making with Saudi support.

The situation within Houthi-controlled areas is also not immune to pressure. Accumulating economic challenges, along with intermittent security and social tensions, make external escalation a risky decision. In such a context, the Houthi leadership may prefer to manage tensions cautiously in order to avoid adding a new military burden at a sensitive moment.

However, these calculations could change if the regional war moves in a different direction. If it evolves into an existential threat to the Iranian regime, or if it drags on long enough to reshape the regional balance of power, the Houthis may find themselves facing a new set of calculations.

For now, the group appears to be a cautious observer. Its rhetoric expresses solidarity with Tehran, but the military decision remains postponed while waiting for the course of the war to become clearer.

The coming weeks will likely reveal the direction the group chooses in this sensitive moment. The issue is no longer simply whether the Houthis will participate in the war or not, but rather how they position themselves in a regional landscape that is being reshaped by the conflict.

Will they remain within their traditional role as part of Iran’s regional network of influence, or will they seek to use this moment to present themselves as a force with its own calculations, managing its regional role according to its own interests rather than the rhythm set by others?