The Docudrama “The Voice of Hind Rajab,” which chronicles the final few hours of the Palestinian girl’s life, was the first film to be premiered at the inaugural Gaza International Festival for Women’s Cinema.

Published On 27 Oct 2025

The Docudrama “The Voice of Hind Rajab,” which chronicles the final few hours of the Palestinian girl’s life, was the first film to be premiered at the inaugural Gaza International Festival for Women’s Cinema.

Published On 27 Oct 2025

After President Javier Milei’s party won a resounding victory in a Sunday midterm election, which is a necessary prerequisite for the continuation of economic reforms and the establishment of a US financial backstop, Argentina’s bonds, stocks, and currency are all rising.

International stocks increased by over 20%, local stocks increased by over 20%, and the peso increased by about 6%, halving the initial rally, on Monday, by international bonds, which increased by 9 to 13 cents each.

list of 4 itemsend of list

Official results from Milei’s free-market reforms and deep austerity measures show that voters in Argentina have strongly supported his policies since taking office nearly two years ago, with inflation steadily falling.

The US pledged a combined $40 billion to Milei, including a potential $20 billion loan facility and a $20 billion central bank swap line, which implied the support was contingent on Milei’s reform agenda.

His victory was “so, so much more than we anticipated,” according to Vontobel Asset Management’s portfolio manager, Thierry Larose. He was previously in a survival state, and he is now very strong in a position to form tactical alliances and push some reforms that were completely out of reach.

Official results show that the opposition Peronist coalition received 40.8 percent of the vote in Buenos Aires province, compared to the president’s party, La Libertad Avanza (LLA), which received 41.5% of the vote. A dramatic political shift has been made in the province, which has long been a Peronist stronghold. LLA won more than 40% of the vote overall, which is a much better outcome than expected.

According to Christine Reed, the manager of Ninety One’s emerging market fixed income portfolio, “Milei’s victory speech was notably moderate and cooperative, showing willingness to work with non-LLA legislators on reforms.”

The US dollar’s benchmark for foreign dollar bonds increased by 13 cents to 73 cents as of the end of the 2038 maturity, in contrast to earlier highs posted earlier this year.

Financial shares increased by 50%, and the Global X MSCI Argentina ETF increased by 20% after falling by 10% year-to-date through Friday. The list of US-listed companies also increased. On US exchanges, prices increased by 34 percent.

The peso was initially up by 13 percent to the dollar at 1,320 per greenback, before rising by 5.8 percent to 1,410 on the day.

According to Matthew Graves, portfolio manager for emerging markets debt at PPM America, the currency’s strength makes sense, especially given the backdrop of US support.

He said, “The government has some breathing room now, and it can decide where to proceed next.” We still believe that a transition to a more a managed-float FX framework can be made easier with the FX bands. Investors will be interested in learning about the potential benefits of this approach as well as how it will help to accelerate the accumulation and rebuild of FX reserves.

Since Milei’s party lost in a provincial election last month in Buenos Aires, Argentina’s assets have been on a roller coaster ride.

Since the start of the year, the peso had fallen by almost 25% and by almost 30% since mid-April’s partial elimination of foreign exchange controls. It hit a record-setting closing low of 1,491.50 per dollar on Friday.

After returning over 100% to investors in 2024, Argentina’s international dollar bonds were among the worst-performing emerging market high-yielders as of Friday.

Last month, the benchmark local stock hit its lowest monthly reading. Its recent increase of more than 20% has slowed to close to 30% from its previous all-time high of January.

Investors claim that as the electoral risk is reduced, Milei’s party’s stronger position in the legislature will now encourage more investment. Even in the upcoming general election in 2027, it raises hopes for reform-minded candidates.

According to Graham Stock, senior sovereign strategist at RBC BlueBay Global Asset Management, “the midterms yesterday just give a longer horizon for potential foreign investments, both in financial assets and in real assets.”

With a wider band or a free float of the peso among the options, confidence in Milei’s reform plan could naturally boost the currency, according to RBC’s Stock. However, some still anticipate a , reforming the foreign exchange framework , that would encourage the accumulation of reserves.

The outcomes, according to Carmen Altenkirch, a sovereign analyst for emerging markets at Aviva Investors, could trigger a “virtuous cycle” in which locals will start selling their currency once more.

A stronger exchange rate, according to Stock, is possible, adding that the country’s key weakness was dollar reserves, which are currently at a loss.

Former US Ambassador to the United States and former US President Joe Biden have accused the administration of softening its conclusions in favor of Israel in a report from a team that investigated the Israeli military’s killing of Al Jazeera journalist and US citizen Shireen Abu Akleh.

The first time a military official involved in the report has spoken out in public was Colonel Steve Gabavics’ statement in an interview with the New York Times that was released on Monday. Gambavis had previously made an anonymous statement for a Zeteo news organization documentary.

list of 3 itemsend of list

The official, who left the government in January, described being “flabbergasted” by a State Department statement that claimed Abu Akleh’s death on May 11, 2022, was “the result of tragic circumstances.” The US government’s only official assessment of the killing to date, which added that there was “no reason to believe that this was intentional,” was added in the statement.

Gabavics was employed by the inter-agency Office of the United States Security Coordinator, which oversees cooperation between Israeli and Palestinian security forces, when Abu Akleh was fatally shot in the Jenin refugee camp in the occupied West Bank.

The Biden administration had assigned the office, which was led by Lieutenant General Michael R. Fenzel, to create a report on the killing that would become available to the State Department.

Gabavics and four unnamed US government officials told the New York Times that the report’s focus on whether the attack was intentional was poorly reflected in the passionate discussion that broke out between them.

As well as visiting the site and overseeing a ballistic analysis, the report relied on findings from Israeli and Palestinian investigations. The US has never made the killing’s own investigation public. The FBI’s investigation was launched in 2022, but its status is still unknown.

Gabavics claimed to be one of the authorities who thought the shooting was a deliberate one. He told the New York Times, “My conscience was on my conscience nonstop,” the government’s watered-down account.

According to Gabavics, it was unclear whether the soldier who fired the fatal shot was actually aiming at Abu Akleh or whether he had at least known that he was doing so.

The assessment aligns with several inquiries by Palestinian officials, UN investigators, and media outlets, including Al Jazeera. Israel eventually acknowledged that one of its soldiers was probably responsible for the killing, which it termed “an accident.” No personnel would be punished, it said.

Gabavics cited Israeli radio military traffic to back up his conclusion, which indicated soldiers were aware of journalists’ presence in the area at the time of the shooting. He added that the journalists’ journalists had not opened fire when the fatal shooting occurred.

Abu Akleh claimed a sniper scope would have been a clear sight when an Israeli military vehicle had been parked across the road from the group of journalists he was accompanying.

Gabavics claimed that the shots’ apparent precision did not indicate an uncontrolled spray. The soldier’s intentionality was also demonstrated by the fact that he shot at a producer, followed by Abu Akleh, and finally at another aid worker.

According to him, “the most absurd thing in the world” would have to have happened for the shooting to have been an accident.

“The person just came out of the truck and was just randomly shooting, and they just happened to have really well-aimed shots and never looked down the scope.” He claimed that “which wouldn’t have occurred”  ,

Gabavics claimed to have written and verbally to General Fenzel, but that his statement was missing from the State Department’s assessment. Gambavics and a number of officials claimed that the review ended with him being removed.

General Fenzel, on his part, defended his choice in a Times statement.

He said, “Ultimately, I had to make judgments based on the full range of facts and information that was at my disposal.” I firmly believe that our work was conducted truthfully and that the conclusions we made were accurate.

Gabavics claimed that the incident heightened the office’s bias toward Israel that he had witnessed. Israel receives billions of dollars in military aid from the US, which has increased since the US’s war in Gaza.

“The Israelis are always the recipients of the favoritism.” He claimed that very little of that is given to Palestinians.

He continued, noting that Abu Akleh’s case had the biggest impact on his career overall.

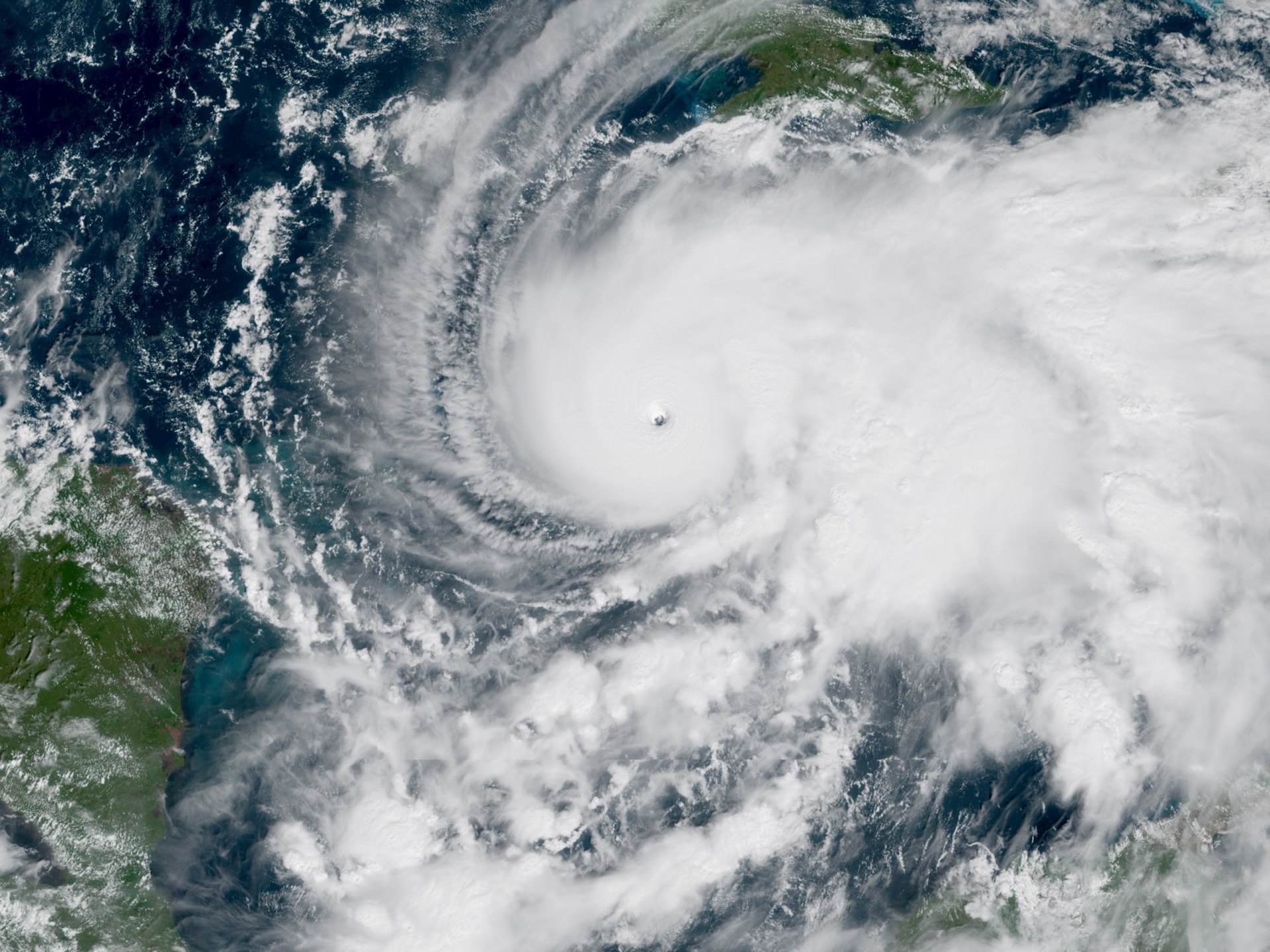

Hurricane Melissa, which is expected to make landfall on Tuesday morning as a potential category five storm, is expected to pose what forecasters call “catastrophic level hazards” for Jamaica.

Published On 27 Oct 2025

Heavy equipment from Egypt is seen digging through rubble in Gaza on surveillance footage. According to The Times of Israel, Prime Minister Benjamin Netanyahu approved the entry of Israeli prisoners’ bodies into Gaza using heavy equipment and Egyptian engineers.

Published On 27 Oct 2025