The Victoria’s Secret runway show, which took place in New York on Wednesday (October 15), saw Jude Law’s daughter, Iris Law, make her debut at the event as she strutted her stuff in an edgy look

Many people were excited to watch the Victoria’s Secret Fashion Show this week as it came back for its second year after a six-year hiatus.

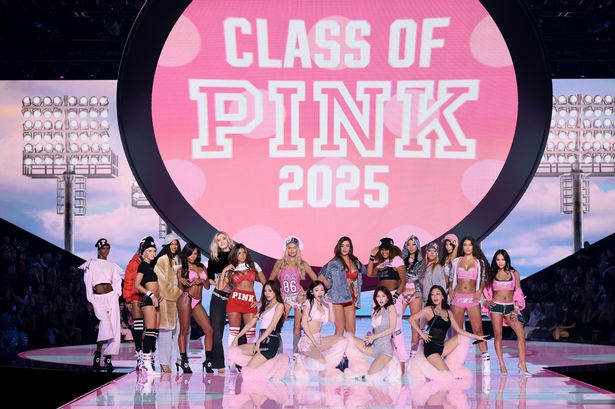

The runway show, which took place in New York on Wednesday (October 15), saw a return to its classic ‘glamorous and sensual’ style as the brand are reportedly focused on ramping up sales. Several stars hits the stage for the runway in New York, including Jasmine Tookes who made history by opening the show while nine months pregnant. She was seen wearing a baby‑bump–accentuating ensemble, which was streamed live on Amazon Prime Video, as she cradled her stomach.

Bella Hadid also captured attention as she hit the runway after being hospitalised last month due to health complications.

However, Jude Law’s daughter – Iris Law – really used the show as an opportunity to put her mark on the fashion industry.

The 24-year-old, who is also Sadie Frost’s daughter, has walked in several high-profile fashion shows throughout her career. She made her runway debut at the Miu Miu autumn/winter 2020 show during Paris Fashion Week, alongside models like Kaia Gerber and Storm Reid.

Since then, Iris, who was born in the US, has appeared on the runways of several other prestigious brands such as in the Roberto Cavalli during the autumn/winter 2022 show in Milan.

She also took part in the Versace runway at Milan Fashion Week in September 2023, wearing a purple floral dress over bikini bottoms with sky-high orange wedges

As well as this, she has fronted campaigns for top brands such as Burberry, Versace, and David Yurman.

Wednesday’s show saw Iris make her debut at a Victoria’s Secret Fashion Show though, as she was seen wearing a sporty, edgy look featuring black-and-white boy shorts with silver trim, a cropped tee reading “Naughty-ish,” a beanie showcasing her platinum blonde pixie cut, as well as athletic socks, high-top trainers, and wrist sweatbands.

Iris was also seen posing backstage in VS underwear and the brand’s iconic pink striped dressing gown.

Taking to her Instagram page, she also shared some behind-the-scenes shots as she sported the infamous VS angel wings while in a lift. She also showed herself working out, getting herself a sweet treat and posing in Victoria’s Secret lingerie.