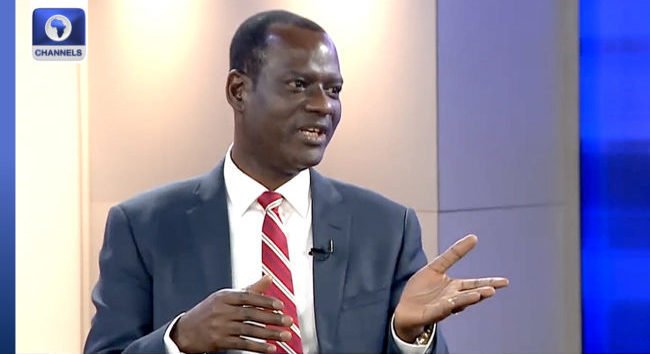

Taiwo Oyedele says banks will be required to request a Tax Identification Number (TIN) from all taxable Nigerians.

The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms said the move is part of the Federal Government’s new tax administration framework set to take effect on January 1, 2026.

”A taxable person is anyone who earns income through trade, business, or any economic activity. So banks must request a tax ID from taxable persons,” Oyedele disclosed in a video on his YouTube channel on Thursday.

READ ALSO: Customs Extend Fast Track Migration Deadline To January 2026

He cited Section 4 of the Nigerian Tax Administration Act (NTAA), which takes effect on January 1, 2026, which he says makes the possession of a tax ID mandatory for all taxable individuals.

?

In this video, we break down the facts around Tax ID and banking, cutting through the confusion and misinformation.

Get a clear understanding of the rules whether you’re a student, worker or… pic.twitter.com/evzSLhis0M

According to Oyedele, the policy has existed since the 2020 Finance Act, but the NTAA now provides the formal legal backing for enforcement.

He added that income earners and businesses already issued TINs will not need to obtain new tax IDs.

“Yes, but with some exemptions. A section of the NTAA requires a taxable person to register and obtain a tax ID,” Oyedele said.

He, however, noted that the requirement does not apply to students or dependents, who will be exempted from needing a tax ID to maintain a bank account.

“This means that individuals who do not earn an income, such as students and dependents, do not need to obtain a tax ID.”

Tinubu Signs Tax Reform Bills Into Law

In January, President Tinubu signed four landmark tax reform bills into law, unifying Nigeria’s fragmented tax system, removing redundant overlaps, boosting investor confidence, enhancing transparency, and promoting coordinated efforts across all levels.

Tinubu described the legislation as a clear departure from previous policies, emphasising that the reforms are designed to ease the burden on working families, small businesses, and low-income earners while eliminating inefficiencies that have long plagued Nigeria’s fiscal structure.

He said the new tax limit forms the groundwork for the Nigeria of tomorrow, focused on unlocking opportunities for all.

The four bills are: the Nigeria Tax Bill (Fair Taxation), Nigeria Tax Administration Bill, Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.

“These reforms go beyond streamlining tax codes. They deliver the first major, pro-people tax cuts in a generation, targeted relief for low-income earners, small businesses, and families working hard to make ends meet.”

Source: Channels TV

Leave a Reply