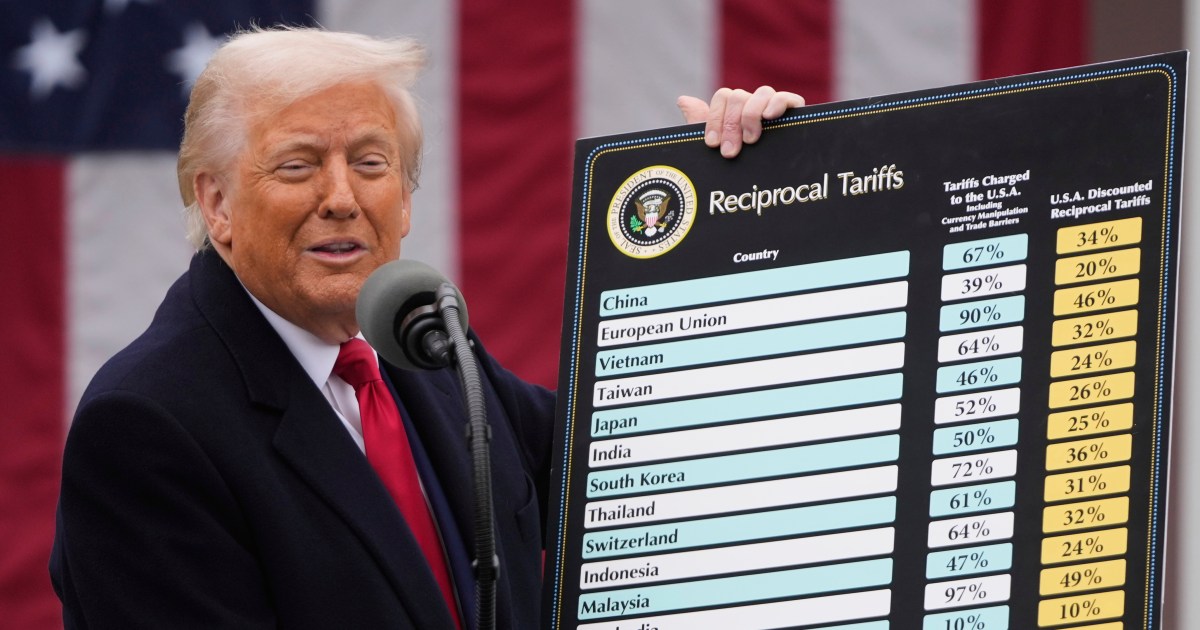

In preparation for President Donald Trump’s July 9 deadline, which requires dozens of nations to reach trade agreements or be subject to significantly higher tariffs, the world economy is in a tizzy.

Following his “Liberation Day” plans, Trump announced in April a 90-day pause on his highest tariffs, which caused the markets to sag in the air.

In the face of persistent uncertainty over Trump’s next steps, US trade partners are frantically trying to reach deals to stop harm to their economies because billions of dollars are in danger of losing.

When the deadline expires, what will happen?

There are significant uncertainty about which nations will be hit and how hard, despite the Trump administration’s claim that trade partners who don’t reach agreements with the US will be subject to higher tariffs.

Trump announced on Sunday that he would begin mailing letters outlining new tariff rates to specific nations this week, as well as announcing that he had ratified a number of new trade agreements.

Trump, without giving a name, promised to write to or sign a deal with “most countries” by Wednesday.

US Treasury Secretary Scott Bessent stated in an interview with CNN on Sunday that tariffs would be levied from August 1 on all nations that do not reach a deal.

Bessent refuted the claim that the deadline had been changed, stating that the affected nations’ tariffs would “boomer back” to levels that were first set to be announced on April 2.

Trump, however, suggested that tariffs could reach 70%, which would be higher than the “Liberation Day” plan’s 50 percent maximum rate.

Trump threatened on Sunday to impose an additional 10% tariff on nations that aligned themselves with the “anti-American policies” of the BRICS, a group of ten emerging economies, including Brazil, Russia, India, China, and South Africa as the founding members, adding to the uncertainty.

“This policy will not make any exceptions.” I appreciate you paying attention to this issue. Trump stated in a statement posted on his Truth Social platform.

Given conflicting information from the White House, Deborah Elms, the head of trade policy at the Hinrich Foundation in Singapore, said to Al Jazeera, “It’s getting harder to guess what might happen.”

I’m not surprised that the US is both writing letters warning of new, potentially higher rates and suggesting that deadlines may be extended to some if offers are deemed to be sufficiently attractive given the lack of “deals” to announce before July 9.

Which nations have negotiated trade agreements with the US?

Only China, the UK, and Vietnam have announced trade agreements that have reduced Trump’s tariffs but not their elimination so far.

Import duties on US goods decreased from 125 percent to 10 percent, while tariffs on Chinese goods were reduced from 145 percent to 30 percent.

However, the agreement only temporarily halted the higher tariffs for 90 days before completely eliminating them, which leaves a number of unresolved issues between the parties.

Following the UK’s agreement, Vietnam’s 46 percent levy was replaced by a 20 percent rate on Vietnamese exports and a 40 percent tariff on “transshipping,” while Vietnam’s agreement saw it continue to levy 10 percent.

Negotiations are currently being conducted, according to a number of other important US trade partners, including Canada, India, Japan, South Korea, and the European Union.

Officials from the Trump administration have stated that negotiations are primarily centered on the twelve and a-half nations, which account for the majority of the US trade deficit.

The EU, the US’s largest trading partner, announced on Sunday that it was working on a “skeletal” agreement that would postpone a resolution of their most contentious disagreements before the deadline to avoid Trump’s rumored 50 percent tariff.

Additionally, according to an article on CNBC-TV18 from India, New Delhi was anticipating a “mini-trade deal” within the next 24-48 hours.

Unnamed sources cited in the CNBC-TV18 report that the agreement would set the average tariff rate at about 10%.

While Trump is likely to announce a few deals resembling those reached with China, Vietnam, and the UK, according to Andrew K. McAllister, a member of Knight’s International Trade Group in Washington, DC, most nations are likely to experience significant across-the-board tariffs.

According to McAllister, “tariffs are here to stay,” he told Al Jazeera.

The tariff setting is what I believe constitutes the bargaining chip. He is much more likely to impose higher tariff levels on nations where the president and administration view tariffs and other non-tariff barriers as significant.

What will Trump’s trade war have on the economy?

Most economists agree that continued, escalating tariff increases would drive up prices and stifle the growth of both the US and the world economies.

Last month, the World Bank and the OECD both downgraded their outlook on the world economy, dropping their forecasts from 2.8% to 2.3%, and 3.9% to 2.9%, respectively.

Trump’s administration’s repeated U-turns and contradictory tariff signals have made it harder to predict the impact of his trade war, in addition.

Trump’s most severe tariffs have been stopped, despite a 10% baseline duty being imposed on all US imports, and Chinese export levies are still in double digits.

According to JP Morgan Research, a 10% universal tariff and a 10% tariff on China would reduce the country’s GDP by 1%, with a 10% drop in GDP from a 60% duty on Chinese goods.

Analysts have warned that inflation may still start once businesses start to burn through stockpiles built up in anticipation of higher costs, despite the fact that the tariffs have already been a modest result.

Despite concerns about sharp price increases in the US, annualized inflation reached a modest 2.3% in May, which is close to the target of the Federal Reserve.

After suffering significant losses earlier this year, the US stock market has recovered to its all-time high, and the US economy added 147, 000 jobs in June, which was higher than expected.

However, other data points to underlying jitters.

The US Commerce Department reported a 0.1 percent decline in consumer spending in May, the first drop since January.

The jury is still out on whether the economy is still waiting for the worst of the tariff hit in general, according to Dutch bank ING in a note released on Friday.

Source: Aljazeera

Leave a Reply