Despite President Donald Trump’s mounting pressure to lower rates, the US Federal Reserve has kept its benchmark rate unchanged.

The Fed announced on Wednesday that it would maintain its short-term rate at 4.25 to 4.5%.

Interest rates haven’t been cut since December, but the central bank’s decision was generally in line with expectations.

The decision comes as economic policymakers weigh warning signs. In its yesterday report from the US Department of Commerce, US retail sales numbers decreased more than expected. The US Department of Labor reported a record number of jobless claims for the week, reaching 248, 000.

The unemployment rate, however, was stable at 4.2 percent, which suggests that the labor market is still relatively stable even though the last jobs report showed that.

The Committee wants to achieve the highest possible rate of inflation and employment over the long-term. The central bank stated in a statement that the outlook’s uncertainty has decreased but is still high.

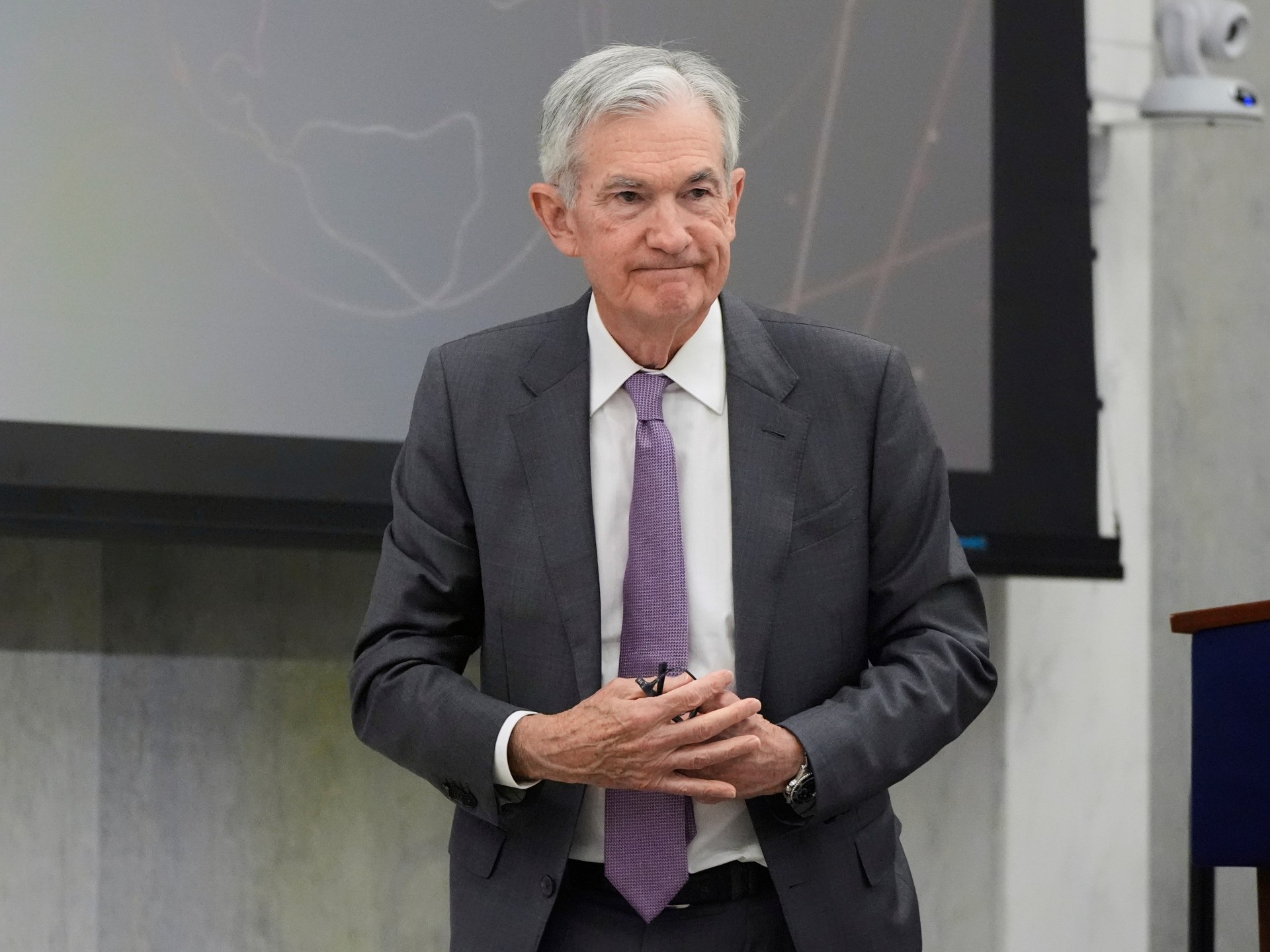

According to Powell, the central bank was holding rates steady in response to uncertainty caused by Trump’s economic and immigration policies as well as consumer prices, a crucial inflation indicator for the Federal Reserve, and that the labor market was not a major source of inflationary pressures. A 2.1% increase for the month of April was revealed in the most recent report.

According to Powell, “we’ve seen goods inflation increase slightly.” More of that is anticipated over the course of the summer, according to the organization. Tariffs must pass through the distribution chain to the final consumer before they can be implemented. We are beginning to notice effects, he continued, and we anticipate seeing more in the upcoming months.

Economists concur.

The US economy is showing more resilience than expected, despite the Fed’s pressure to raise rates. Only 1.4 percent of the US’s overall growth forecast for 2025 is currently in place. The nominal growth rate would be the lowest since 2020 if inflation were to reach 2.4 percent as of the most recent reading. According to Global X’s SVP and head of investment strategy, Scott Helfstein, the US growth rate could increase, which is warranted waiting.

“The jobs number has consistently performed better than anticipated.” Full employment and price stability are the requirements of the Fed. While both risks have increased as a result of policy uncertainty, the data fails to account for labor weakness or an increase in inflation. That is the central point of this Fed calculus.

Jerome Powell, the former Fed Chair, doesn’t seem to feel too hot. However, if there had been any easing, it would have been “absolutely stimulative” and lowering the interest rate on US debt, according to Michael Ashley Schulman, the partner and chief investment officer at Running Point Capital Advisors.

Policymakers are considering the escalating Middle East tensions and the looming and consistently shifting changes to Trump’s tariff policies. Prior to Israel’s attack last week on Iran and its retaliatory strikes, oil prices were in decline, but worries about the Strait of Hormuz closing as tensions rise have grown. Prices may also be going up in the coming weeks.

Powell is the subject of Trump’s criticism.

Trump criticized the central bank’s decision to hold rates steady before the rate announcement, which he had previously expressed disappointment with.

He remarked on his desire for rate cuts, saying “Powell’s too late.” Because he’s always too late, I refer to him as “too late Powell.” Trump said, “If you look at him, you know that I always knew that when I did this, I always knew that he was mistaken.”

It is unclear what Trump meant by “may have to force something,” he added.

He also suggested that he should serve as central bank’s leader. Trump reportedly said, “Maybe I should contact the Fed.” Can I choose my own appointment at the Fed? I’d perform much better than these people.”

Trump has recently rebuffed his call to fire the central bank head, and Powell’s term is set to expire in May.

He leaves in about nine months, he has to, and fortunately, he is terminated, according to Biden, former president. Trump said, “I don’t know why that is, but I suppose he was a Democrat, who has done a poor job.”

Source: Aljazeera

Leave a Reply