Oil prices rose over the weekend after the US attacked Iran’s nuclear facilities, hitting a five-month high. The US Al Udeid Air Base in Qatar was attacked by Tehran in retaliation, which has hampered global energy markets.

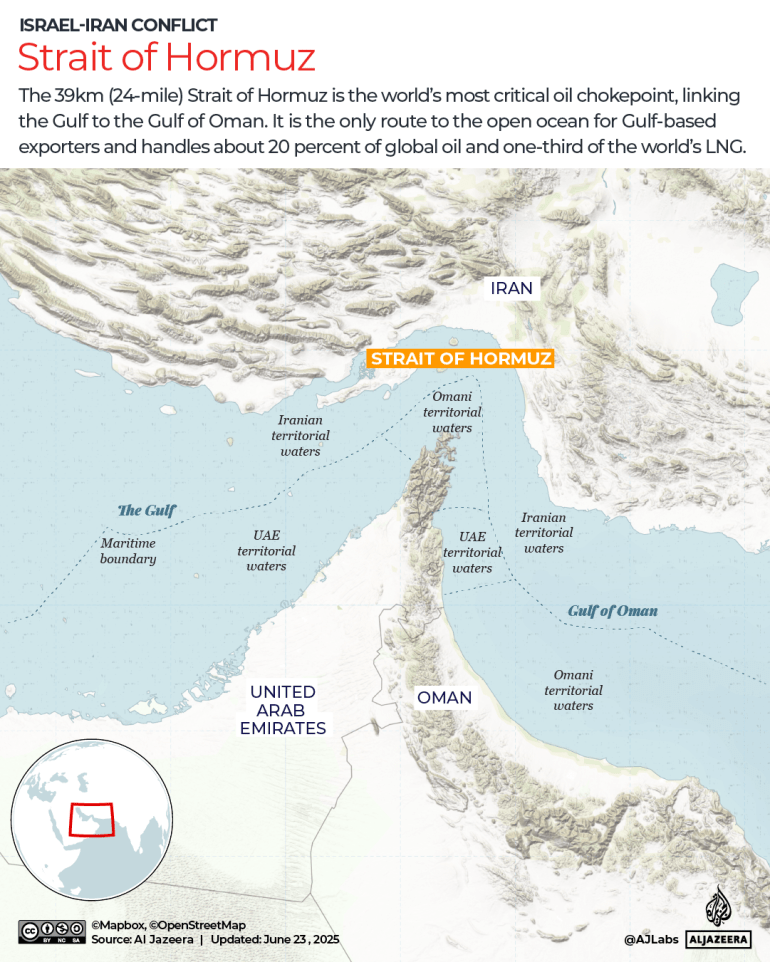

However, after it appeared that Iran was holding off further attacks for the time being, including avoiding closing the Strait of Hormuz, a crucial chokepoint in global trade, oil prices sharply dropped on Tuesday.

Brent Crude, the world’s benchmark for oil prices, has fallen more than 5.6 percent so far in the day’s trading and is currently trading at about $66 per barrel.

Still a concern is the closure of the Strait of Hormuz.

The Strait of Hormuz closure might be one of Iran’s most significant potential retaliatory economic measures.

The trade corridor between Europe and Asia is crucial because it supplies 20% of the world’s oil supply and serves as a major transit route.

The Supreme National Security Council of Iran has the final say over a proposal to close the strait, despite the country’s parliament backing it.

Iran has previously threatened Iran in the past, including in 2018 during US President Donald Trump’s first term following US withdrawal from the Iran nuclear deal that was brokered by former US President Barack Obama.

The strait, which is only 33 kilometers (21 miles) wide at its narrowest point, could be closed, and it could even be used to attack or seize ships. The Revolutionary Guard recently seized ships it claimed to have smuggled diesel. In the 1980s, similar strategies were employed in the Iran-Iraq War.

Although analysts believe there is enough spare capacity to at least partially offset the immediate impact, closing the Strait would cause a swell in global markets. The risk of additional volatility persists, similar to the disruptions to the energy market in 2022 brought on by Russia’s invasion of Ukraine.

If the Strait is closed, crude oil prices could top $80 per barrel, according to HSBC analysts. It could be worth ten dollars, according to Goldman Sachs.

However, the US airbase strike on Qatar actually sabotaged global markets because it suggested that Tehran’s arsenal prioritized economic retaliation.

An oil tanker would sink in the Straits of Hormuz if Iran were serious about retaliation. In a post on the social media platform X, senior fellow at the Brookings Institution, Robin Brooks, stated that the fact that it isn’t acting means that it is bent.

Moment of flux

The oil market was already in a state of flux before the conflict. As part of a strategy to unwind voluntary output cuts after the COVID pandemic, OPEC agreed to increase production by up to 411, 000 barrels per day for the month of July.

There are other ways to lessen a supply shortage’s impact.

According to Third Bridge Capital’s analysis, the production capacity of OPEC+’s OPEC+, primarily in Saudi Arabia and the United Arab Emirates, could quickly add 2.5 million barrels per day to the market, with up to 5 million more available over the long term.

If global oil supplies are hit before it ultimately has an impact on gas prices, that could save time.

Due to the current global sanctions against Iran, the country currently accounts for 4 percent of the world’s oil supply. The majority of this is exported to China.

According to Peter McNally, the global head of Sector Analysts and global sector lead at Third Bridge Capital, “It’s difficult to see how Iran would push more barrels into the market given the current environment, since a lot of their supply ultimately goes to China.”

Iran exports about 1.6 million barrels of oil annually, accounting for nearly 90% of those exported by China. According to Abigail Hall Blanco, professor of economics at the University of Tampa, China is already grappling with US tariffs and will suffer from a downward trend in energy prices.

Oil markets have a lot of interconnectedness. And so, Hall Blanco told Al Jazeera, “you would see those effects on the US and other markets as well” if the price of oil rose globally as a result of a closure or restriction of oil tankers passing through the strait.

Trump stated earlier this morning that China could continue to purchase Iranian oil, indicating a change in US policy since Trump has so far attempted to stop Iran’s oil exports. According to Reuters news agency, he had also imposed sanctions on several of China’s so-called “teapot” refineries and port terminal operators in relation to purchases of Iranian oil.

Regional producers are in the process of preparing for any fallout. The state-run Basra Oil Company in Iraq has begun evacuating foreign employees because it fears Iranian action against US forces stationed there.

Western businesses are also taking precautions. The number of people on-site has decreased because BP collaborates with Iraq’s Basra operation, which produces 3.32 million barrels of oil annually. The business claims that output won’t be impacted. BP’s stock is down 1.4 percent as of 3 p.m. EST in New York at 3 p.m.

Producers outside of OPEC+ could increase output to help bridge any supply gaps, such as those in Brazil, Canada, Guyana, and the US. However, according to experts, other nations take longer to make those moves, with the exception of the US and Canada.

The US’s lead time is merely a little longer than everyone else’s, according to the statement. Less of a quick response to higher prices is possible. The growth will continue. The quickest [way] to increase production is either Saudi Arabia, the UAE, or the US, McNally said, via Iran and the Strait of Hormuz, if there is a supply outage. However, the non-OPEC supply will continue to meet the majority of the growth in demand over the long term.

Non-OPEC nations have significantly increased production over the past ten years, a trend that is expected to continue. According to the Energy Information Administration (EIA), non-OPEC sources will account for 90 percent of oil production growth this year (PDF).

Additionally, the US currently has access to a 402.5 million barrel strategic petroleum reserve. In situations where production is sluggish due to global emergencies, the reserve can be used.

At current levels, it will cost $20 billion and take several years to refill the strategic reserve, despite the fact that the US produces more oil than any other nation in the world.

Trump faces a political hazard.

Trump on Truth Social said, “Everyone, KEEP OIL PRICES DOWN, I’m WATCHING,” in all caps on Monday.

Trump campaigned for lowering the cost of common goods. However, his erratic trade practices and tariffs have increased prices. Food prices have increased by 2.9 percent over the last year, according to the most recent consumer price index report, a crucial indicator used by the central bank to gauge inflation.

However, the Trump administration has remained focused on oil, with prices falling, among them gas prices, by 12% from the same period last year.

However, as prices fluctuate, that could change very quickly.

Source: Aljazeera

Leave a Reply