A group of former Premier League footballers say they lost tens of millions of pounds because of their financial advisers.

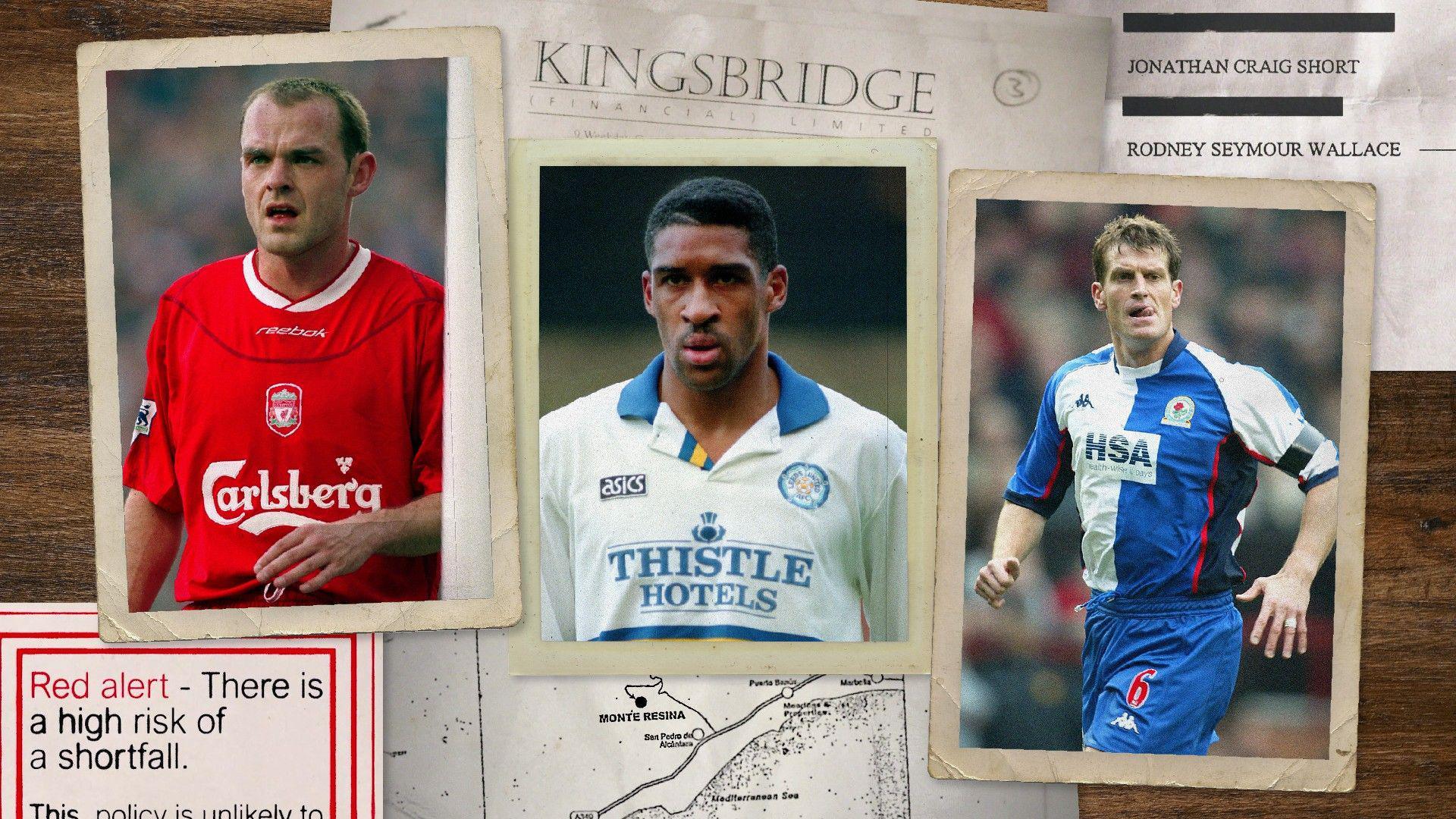

The V11 campaign group, which includes 11 footballers who made investments with Kingsbridge Asset Management in the 1990s and 2000s, includes Danny Murphy, Michael Thomas, and Rod Wallace.

Former England international Murphy, who is now a Match of the Day pundit, believes he was victim of “financial abuse” and lost roughly £5 million.

David McKee and Kevin McMenamin, who ran Kingsbridge, say they “deny any wrongdoing”.

Kingsbridge always gave sound advice and clearly defined the risks and opportunities, both before and after any investment agreement, they told the BBC.

Up to 200 footballers may have been affected, with some going bankrupt and losing their homes.

‘ It was like wildfire – word of mouth ‘

The V11 group also includes Brian Deane.

He scored the first Premier League goal in 1992. With the introduction of new players and increased player wealth, a new era of the game was born.

Deane, who like many others hoped the investments would secure his financial future, said, “We should have felt protected.”

“Kingsbridge seemed to be in line with what everybody wanted at the time, which was to have somebody looking after your finances for when you finished playing”.

McKee and McMenamin founded Kingsbridge Asset Management in Nottingham the year the Premier League was playing.

More than 360 footballers were among its clientele on its website.

“If they got the most influential person in the changing room, you thought you were in a safe place”, said Deane.

These men have “ruined our lives,” they claim.

Former Aston Villa and Celtic striker Tommy Johnson was introduced to Kingsbridge by his agent.

He claimed that many of the Villa players’ advisers were his financial advisers.

Johnson went on holiday with McKee and McMenamin, and they were even guests at his wedding.

He said, “People will turn around and say they are just financial advisers.” They were friends, not enemies. These guys have ruined our lives”.

“We were honored during our careers to have been trusted by [our] clients… that trust was never betrayed,” McKee and McMenamin told the BBC.

Through its partnership with the League Managers Association, the business gained credibility.

Wallace became Leeds ‘ record signing in the summer of 1991.

Knowing that managers were involved was one of the biggest benefits for us, he said.

“My wife and I wanted to start a family,” my wife said. It was just a natural thing really, just go with them”.

Wallace only discovered something wrong with his investments in 2008 when he made the discovery. His net worth was reportedly $1. 9 million. By February 2024, he was declared bankrupt.

He said, “We live in Surrey.” It’s been a nice place to live, but we’re currently being forced to move because there’s no money in the bank. We won’t have anywhere to live”.

Wallace owned shares in Kingsbridge, too.

He claimed that this was his first stock purchase. “I was just told that they bombed. I’m just gone.

Additionally, Wilkinson held shares.

Yet a letter seen by the BBC suggests he was paid £2, 033 a month for four years by Kingsbridge, in “recognition of the fact” he kept his shares “solely]in] the best interest of the LMA’s business partnership with Kingsbridge”, even as they lost value.

According to the LMA, “Any agreement between David McKee and Howard Wilkinson was a personal agreement… to which the LMA was not a party.”

According to McKee and McMenamin, “Howard Wilkinson never referred business to us or introduced a client.”

What became of the investments?

In an effort to boost the UK film industry, the Treasury introduced a tax relief in 1997 for investments in domestic films.

“What the government didn’t envisage was the tax advantages would be abused and turned into a financial product”, said investment fraud lawyer Ben Rees.

Kingsbridge advised clients to use their own money and bank loans to finance movies.

Wallace invested more than £2 million into the sector.

Players were then encouraged to invest in property with a 40% tax rebate, that did not need to be repaid for 15 years.

In a Monte Resina development in Spain, four members of the V11 group purchased apartments for 618, 500 euros.

According to Deane, “They brought it to me and the other guys thought it was a very exclusive development that was just too good to miss.”

However, documents seen by the BBC show McKee and McMenamin originally owned the apartments and instructed a company – run by McKee’s wife – to manage them.

Investigative journalist Richard Belfield remarked, “Talk about a conflict of interest.”

Craig Short, a former Derby County and Everton defender, was advised to invest in a Charlotte Harbor development in Florida.

He claimed that “the first property had no value whatsoever.”

“I had a huge mortgage on it which I just couldn’t afford. I decided to walk away and return the keys as soon as possible.

Many of the investments had decreased, leaving players unable to pay the tax bills as HMRC eventually chased the tax owed from the film schemes.

Rees was introduced to the V11 group through a charity.

Rees said, “I think every professional adviser makes mistakes, but the volume and consistency of these complex, high-risk, and unregulated investments were just completely inappropriate for young, naive, kind of financially inexperienced footballers.”

The advisory firm itself has an interest in the projects or is involved in them in some way, the advisory firm says, “so that’s not a mistake when you start seeing the investments.”

McKee and McMenamin said in their statement to the BBC: “Film schemes attracted huge support from all areas of the financial services industry.

Any losses suffered by clients are deeply regrettable but were caused by HMRC policy changes and the collapse of the global real estate market in 2008.

The V11’s Tale of Football’s Financial Shame

What actions have the police taken?

After Andy Burnham, the current mayor of Greater Manchester, referred the matter to them in 2018, City of London Police opened an investigation.

Two men from the East Midlands were arrested.

The investigation was ended two years later, however, with the police determining there was “insufficient evidence to support a realistic chance of conviction.”

According to City of London Police, “the decision was made at the commander level and… an external force senior officer also supported the decision.”

HMRC will probably impose a fine, but I have nothing to offer.

More than £1 million in tax is paid by each V11 group member on average.

Former Fulham midfielder Sean Davis owes £330, 000 and now works as a painter and decorator.

He said, “It was a shock when I started getting the brown letters through the door.”

“I’m at my happiest when I’ve had a drink because you kind of forget about it,” I said. But then when I wake up the next day that’s when I’m at my worst. I sarcastically want to commit suicide.

Thomas, in contrast, claimed he was “living like a clown.”

“All fun on the outside – laughing and joking – but every day I think about a lot of things… and I’m one of the lucky ones”, said the former Arsenal and Liverpool midfielder.

Although it’s difficult to speak out in public, I thought, “I have to speak out for people who are suffering in silence.”

His tax liability was revealed to be £1.6 million when the brown envelopes arrived at Short’s door.

He received a bankruptcy petition on Christmas Eve, and bailiffs turned up at the training ground of Oxford United, where he works as a coach.

He said, “I have frequent episodes of depression, sadness, and anger.” I have nothing to give them, so HMRC will probably enforce.”

In a statement, HMRC said: “We have a duty to collect tax when it is legally due.

I don’t know where I would be if it weren’t for the group.

The V11 campaign group was assembled by Short’s wife Carly Barnes-Short – a solicitor and former criminal defence lawyer.

She said, “We have team captains, Premier League title holders, Champions League winners, FA Cup winners, and other names.” This group of players has achieved tremendous success.

Her aim, together with the 11 retired footballers – not all of whom wanted to go on the record about their experiences – is to change the law to protect victims of crime from serious tax charges.

“It goes back to what we did as players,” Deane remarked. We were a team, and that is where we have developed our strength.

” It’s definitely saved lives, “said Murphy, who won the Uefa Cup, FA Cup and EFL Cup with Liverpool.

I don’t know where I would be right now if it weren’t for the group.

Davis was one of the many former football players who kept his financial issues a secret before joining the group.

The possibility of changing the law encouraged him to speak about them publicly for the first time.

Davis said, “I don’t want to be saying all this and then there won’t be any change.”

That would be worse, and it would be like losing once more.

related subjects

- Premier League

- Football

Source: BBC

Leave a Reply