A simple illustrated guide to zakat, answers to 7 common questions

Many Muslims around the world are getting ready for the final days of the fasting month of Ramadan by giving the zakat.

In Islam, zakat is a required charity that serves the needs and promotes economic equality.

To help you understand the purpose, calculations, and benefits of zakat, we answer seven frequently asked questions in this visual explainer.

What do Shakat and Shaq mean?

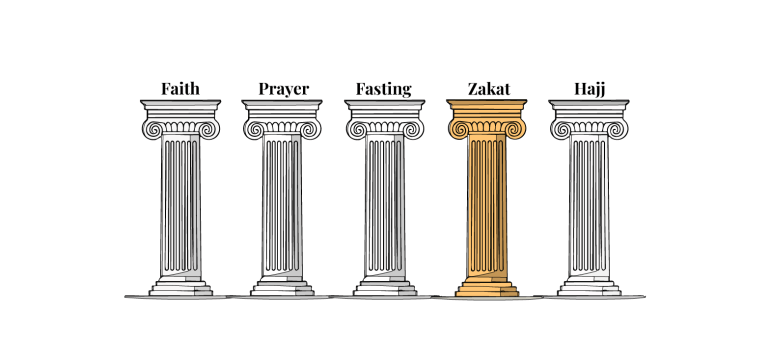

One of Islam’s five pillars, zakat, makes it its main form of worship. The Quran commands the use of the word zakat to promote social justice, promote social justice, and assist those in need. The word zakat means purification or growth.

Muslims who meet the financial threshold, or nisab, are required to pay zakat annually at a fixed percentage of 2.5 (one-fourth) of their wealth. Later, we’ll learn more about how this is calculated.

Sadaqah, on the other hand, is a voluntary charity that can be given at any time.

Who must administer zakat?

Adult Muslims who have attained the minimum level of income and who are eligible for zakat must pay it.

According to current market prices, the nisab is equivalent to 85 grams (3 troy ounces) of gold, or roughly $9, 000.

There is a silver standard in addition to the gold standard for determining the nisab amount. Silver’s nisab is equivalent to 595 grams (19 troy ounces) of the metal in terms of weight. This accommodates a range of economic conditions, making zakat accessible and relevant to a wide range of people.

A Muslim must pay zakat if their wealth exceeds the lunar year’s mark.

What varieties of zakat are there?

Zakat al-mal and zakat al-fitr are the two main zakat types.

The most well-known form of zakat is “zakat al-mal,” which means “zakat on wealth.” Muslims who have more than the nisab threshold are required to donate 2.5 percent of their assets each year.

Before the Eid prayer, which commemorates the conclusion of Ramadan, Zakat al-fitr is a required charitable donation. It is distributed to aid those in need during Eid. The cost is typically the same as one person’s meal.

What resources are zakatable?

Zakat must be paid for all assets, savings, investments, and profits, including:

Zakat is not required for tangible things like:

Zakat is calculated in what way?

One-fourth of one’s eligible wealth is the standard zakat rate, which is 2.5 percent (one-fourth).

For example, if one’s wealth liable to zakat is $10, 000, the due amount is $250 ($10, 000 × 2.5% = $250).

Who is eligible for zakat?

Zakat aims to support the less fortunate and reduce poverty. Therefore, Muslims who meet the requirements for need and lack of wealth must receive it. Eight categories of people are permitted to receive zakat according to the Quran:

- The poor are those who have little to no money.

- The underprivileged – those with limited resources but no stability in their lives

- Zakat administrators: those or groups responsible for obtaining and distributing zakat.

- New Muslims: those who have been converted or who are seeking Islam and require financial support.

- People who are in debt are those who are burdened by debts they are unable to pay.

- Those who are stranded traveler – those without financial support when they are away from home.

- People engaged in charitable work – those who practice religion, education, or humanitarian causes.

- Captives and slaves were once used to free slaves in the past, but they are now used in modern forms of slavery, such as bonded labor.

Zakat cannot be distributed to members of one’s immediate immediate family, such as their parents, children, or spouses. It is also not available to those who have incomes greater than the nisab threshold.

When is the proper time to pay Zakat?

Zakat can be given at any time during the year, though many people do so during Ramadan for the spiritual rewards.

A Muslim must pay zakat once its wealth has reached the nisab threshold, provided they have lived in it for the entire lunar year (known as hawl).

For instance, a person is required to pay zakat if their wealth exceeds the nisab threshold for the entire year.

However, there is no need to pay zakat if the average household income falls below the nisab.

For instance, a person’s wealth does not need to pay zakat if it exceeds the nisab for a number of months before it is fully repaid. The obligation to pay zakat only arises when their wealth exceeds the nisab for a perpetual lunar year.

If someone doesn’t pay zakat as promised in previous years, they must make the calculation and payment retroactive.

Zakat can be distributed in the manner of Zakat, either directly to those in need or through reputable charities and organizations. It can also be distributed internationally where there is a greater need, if it is encouraged to help those nearby.

Zakat encourages a more equitable distribution of resources, promotes economic balance, and reduces income inequality by making wealthy people pay a portion of their assets.

Source: Aljazeera

Leave a Reply